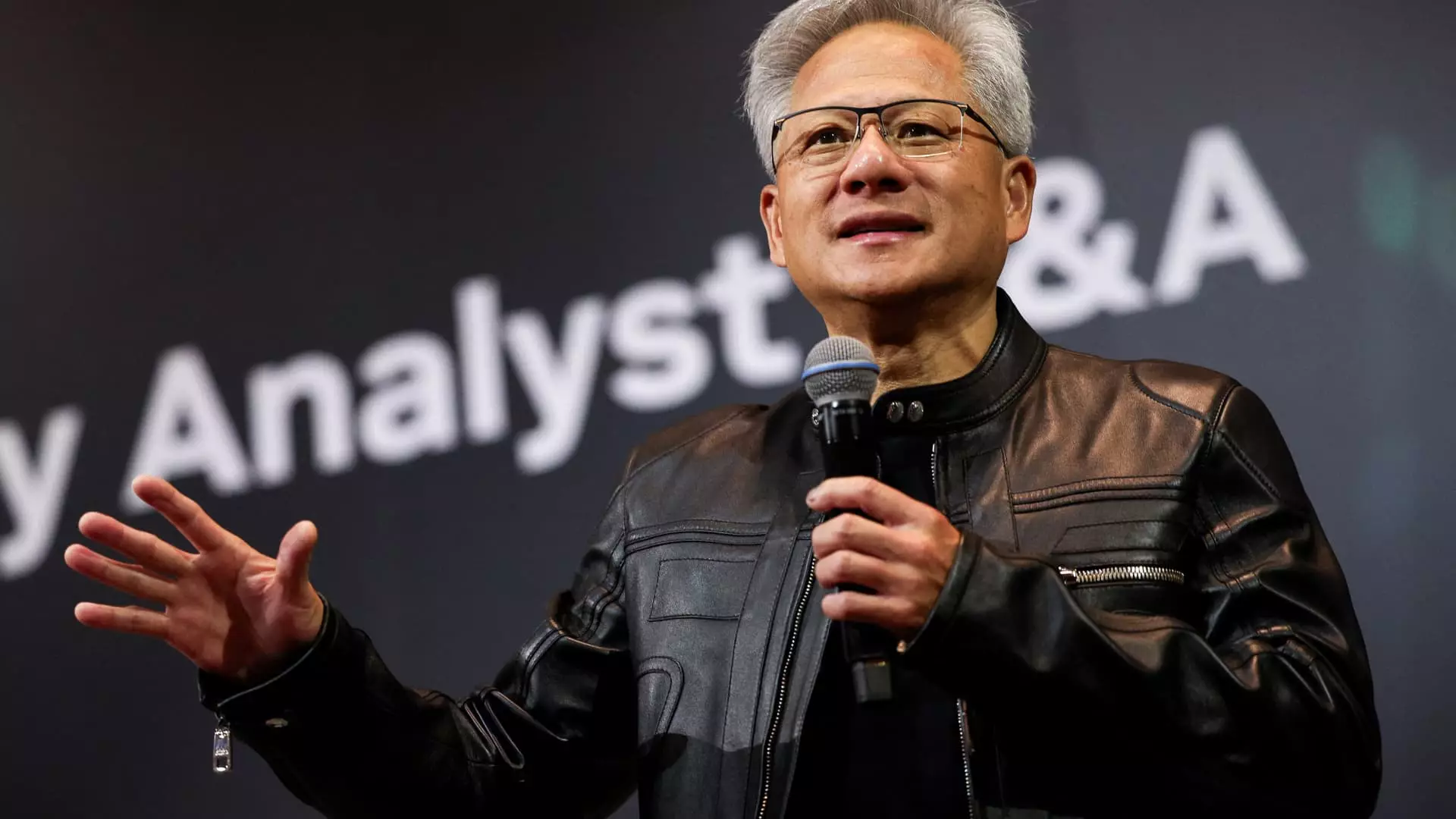

Jensen Huang’s recent stock sales, totaling nearly $50 million in just a few days, raise serious questions about the stability and transparency of Nvidia’s leadership. While executive stock sales are often viewed with suspicion, in this case, the timing appears particularly suspicious. The sales coincide with Nvidia’s unprecedented market valuation exceeding $4 trillion—an achievement many attribute to the booming demand for AI technologies. However, insider selling at such a moment suggests that the company’s leadership might be subtly signaling doubts about Nvidia’s ongoing growth trajectory. Rather than instilling confidence, these transactions might erode investor trust, especially when they are executed amidst geopolitical tensions and export uncertainties related to China.

Market Overconfidence or Underlying Risks?

Nvidia’s apparent success seems to have fostered an atmosphere of market overconfidence. The company’s push into artificial intelligence and strategic expansion into China, despite previous restrictions, illuminate an overly optimistic outlook—one that leaves little room for skepticism. Huang’s desire to sell more advanced chips to China—pending U.S. government approval—ties Nvidia’s future directly to geopolitical dynamics that are inherently unstable. The U.S. government’s selective approach toward licensing export of high-tech equipment to China hints at an underlying risk: the possibility that future political decisions could significantly hinder Nvidia’s growth prospects in one of the world’s largest markets. Such reliance on uncertain political goodwill leaves Nvidia vulnerable to sudden regulatory shifts.

Leadership’s Overreach and Compromised Confidence

The huge insider sales may be a manifestation of overconfidence from Nvidia’s leadership, a classic case of executives cashing out amidst mounting company valuations. While capitalizing on recent gains is understandable, doing so when China’s access to critical technology remains uncertain is reckless. Huang’s comments about selling more advanced chips to China reveal a willingness to bet heavily on easing export restrictions—yet such bets could turn sour if political winds shift further against U.S.-Chinese tech relations. The leadership’s apparent overreach risks damaging Nvidia’s reputation and undermining confidence in their strategic vision, particularly when they seem caught between expanding market opportunities and unpredictable geopolitical realities.

Economic Implications of Strategic and Regulatory Risks

Nvidia’s soaring valuation is built not only on technological innovation but also on geopolitical optimism. However, reliance on regulatory approvals to sustain growth can backfire spectacularly. If export licenses for key chips are delayed or revoked, Nvidia’s expansion into China could be stunted, exposing the company to severe revenue setbacks. The recent display of executive stock sales underscores a broader reality: Nvidia’s fortunes are increasingly tied to government approvals and diplomatic relations, rather than purely market-driven factors. This intersection of tech innovation and geopolitics introduces systemic vulnerabilities that could threaten Nvidia’s dominance—especially if political tensions escalate and regulatory policies tighten further.

Jensen Huang’s aggressive stock dumping, coupled with the company’s risky geopolitical gambles, should serve as a warning. When corporate leadership relies too heavily on government goodwill and market exuberance, they risk sacrificing long-term stability for short-term gains. The future of Nvidia, despite its current triumphs, hinges precariously on unpredictable political decisions and internal leadership decisions that seem increasingly detached from the core fundamentals of prudent growth and investor trust.