In recent weeks, Equinix’s stock has taken a significant hit—down nearly 18% after revealing increased capital expenditure plans and a diminished near-term AFFO outlook. The market’s knee-jerk reaction reflects short-term discomfort with the company’s apparent cost burden, but this myopia overlooks the bigger picture: Equinix’s forward-looking strategy is fundamentally sound, emphasizing long-term growth amid the accelerating digital transformation worldwide. Investors fixated solely on near-term metrics fail to appreciate that the company’s ambitious expansion, especially with AI-driven opportunities, is a calculated bet that will ultimately amplify value. A true visionary understands that a company’s current ‘pain’—be it higher CapEx or temporarily softer AFFO—is an investment in future dominance. Allowing short-term panic to overshadow strategic depth does a disservice to long-term shareholders who prioritize sustainable growth over fleeting profits.

Data Centers and the Critical Role They Play in Modern Economy

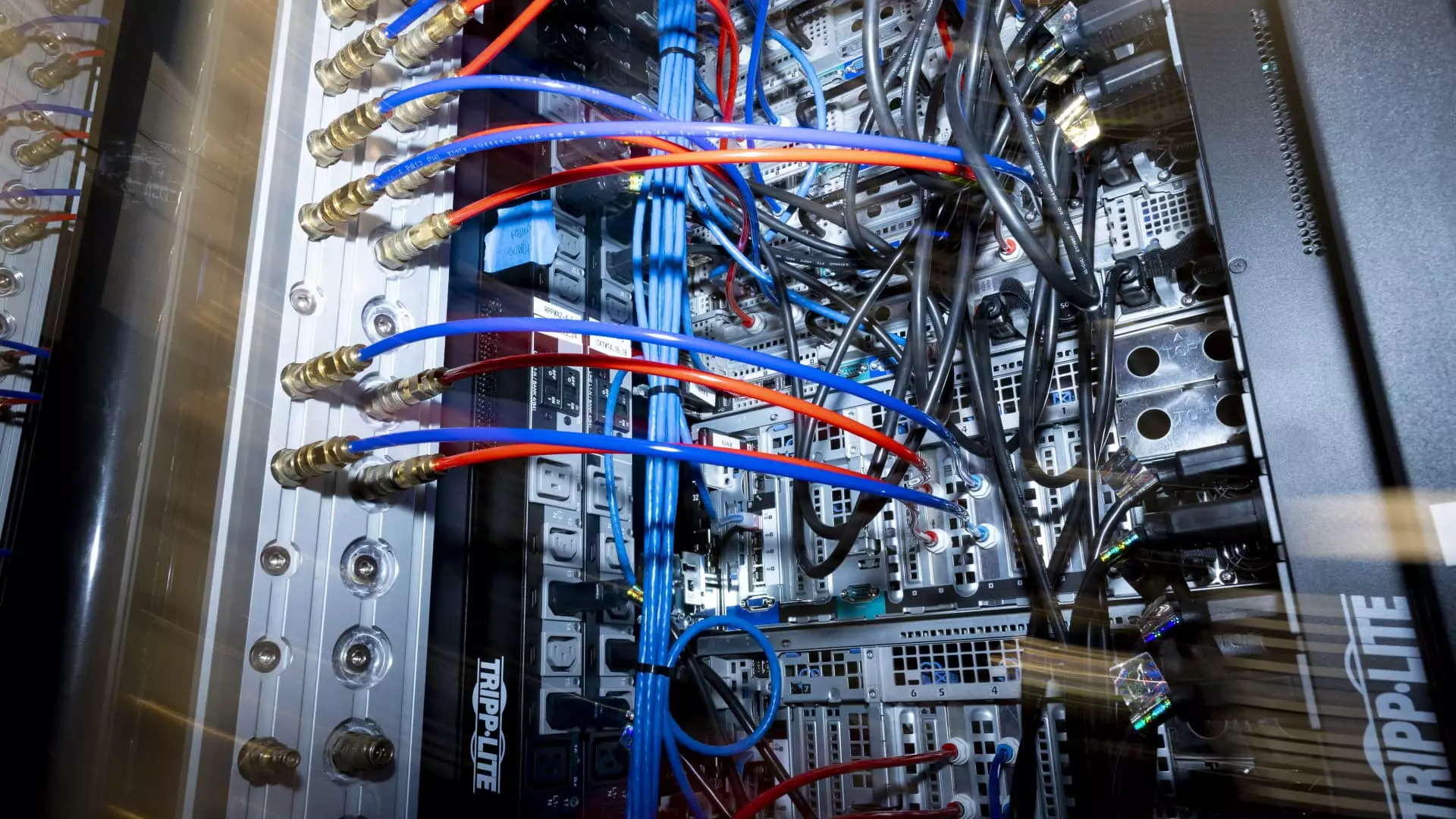

In a world increasingly dependent on data, companies like Equinix are pivotal. They are not just real estate plays; they are foundational infrastructure providers essential for cloud services, network interconnection, and emerging AI workloads. As digital giants expand their footprints and AI models become more prevalent, the need for scalable, interconnected data centers will skyrocket. Equinix’s global reach—spanning 75 metro areas—positions it well to capitalize on this surge. Yet, many investors overlook the strategic importance of colocation providers; instead, they focus solely on current margin figures and short-term risk. Such shortsightedness neglects the fact that demand for data center space is resilient and driven by structural trends like cloud migration and AI growth. Equinix’s approach of locating near key end-user markets enhances customer stickiness and provides a competitive moat, advantages that under-resourced or less strategic players cannot immediately replicate.

The Illusion of Cost and CapEx: Long-term Opportunity, Not Burden

The recent market drop following the disclosure of hefty capital expenditure plans is a textbook example of short-termism. Management’s announcement of spending $3.3 billion in 2025 and potentially up to $5 billion annually afterward might look alarming on paper. However, these figures are not just expenses—they are investments in a future where data center demand is set to soar. The expectation of a 20% to 30% return on CapEx, fueled by AI, hyperscaler demand, and network interconnection requirements, suggests these outlays will pay off well beyond the next fiscal year. The short-term dip in AFFO (projected down to 5%) is a fitting reflection of the typical lag between CapEx deployment and cash flow realization. Savvy investors recognize that patience and strategic capital deployment are prerequisites to long-term valuation appreciation. Detaching from the noise and understanding the industry’s growth trajectory is essential for grasping the real value proposition.

The Strategic Role of Activist Investors and the Power of Industry Expertise

Elliott Management’s recent increased stake signals a belief that Equinix’s growth narrative can be accelerated and optimized. Unlike passive investors, Elliott’s track record of active engagement—ranging from board seats to strategic initiatives—demonstrates that having an experienced, industry-savvy partner at the table can make a tangible difference. Their familiarity with data centers, born from ownership and operations of firms like Ark Data Centers and their activism at Switch, gives Elliott unique insights. With this background, Elliott can push for smarter capital allocation, enhanced communication strategies, and operational efficiencies. The firm’s industry experience allows it to push for improvements in areas like AI inferencing infrastructure—an untapped opportunity for Equinix to leverage its interconnected platforms. In essence, Elliott’s involvement could transform what appears as a temporary setback into a platform for sustainable competitive advantage.

Unlocking the Real Growth Potential Through Better Communication and Strategic Focus

One of the key lessons from Equinix’s recent share price decline is that market communication matters immensely. Investors often react negatively not necessarily because of fundamental flaws but due to insufficient clarity about strategic plans. Equinix can benefit from better transparency regarding its AI ambitions, capital deployment timelines, and long-term growth forecasts. As AI matures, the company’s position as a central data hub for inference and AI deployment will become increasingly invaluable. Additionally, refining its cost structure—through operational efficiencies or financial engineering—can improve margins and shareholder returns. With margins already among the highest in the sector, modest enhancements could set the stage for outperformance relative to peers like Digital Realty. An experienced activist like Elliott could help shape this narrative, ensuring that the company’s strategic efforts are effectively communicated to the market and reflected in its valuation.

The Path Forward: Reinventing a Traditional Business in a Digital Age

The future of Equinix hinges on its ability to navigate both infrastructure investments and technological shifts, most notably AI. While the current market reaction highlights the risk perception associated with hefty CapEx, it also underscores a misunderstanding of the industry’s true dynamics. The company’s repositioning toward AI inference, edge computing, and hyperscaler expansion demands bold investments that will ultimately redefine data center economics. As the company’s margins expand and its growth accelerates, the initial pain from CapEx will give way to a more robust valuation—if managed well. Here lies a lesson for investors: the real winners in the digital age are those who view infrastructure as a competitive advantage and are willing to look beyond short-term fluctuations to grasp long-term transformations. Equinix’s trajectory is promising, but only if it fully leverages its assets with strategic clarity and the backing of industry-savvy advocates.