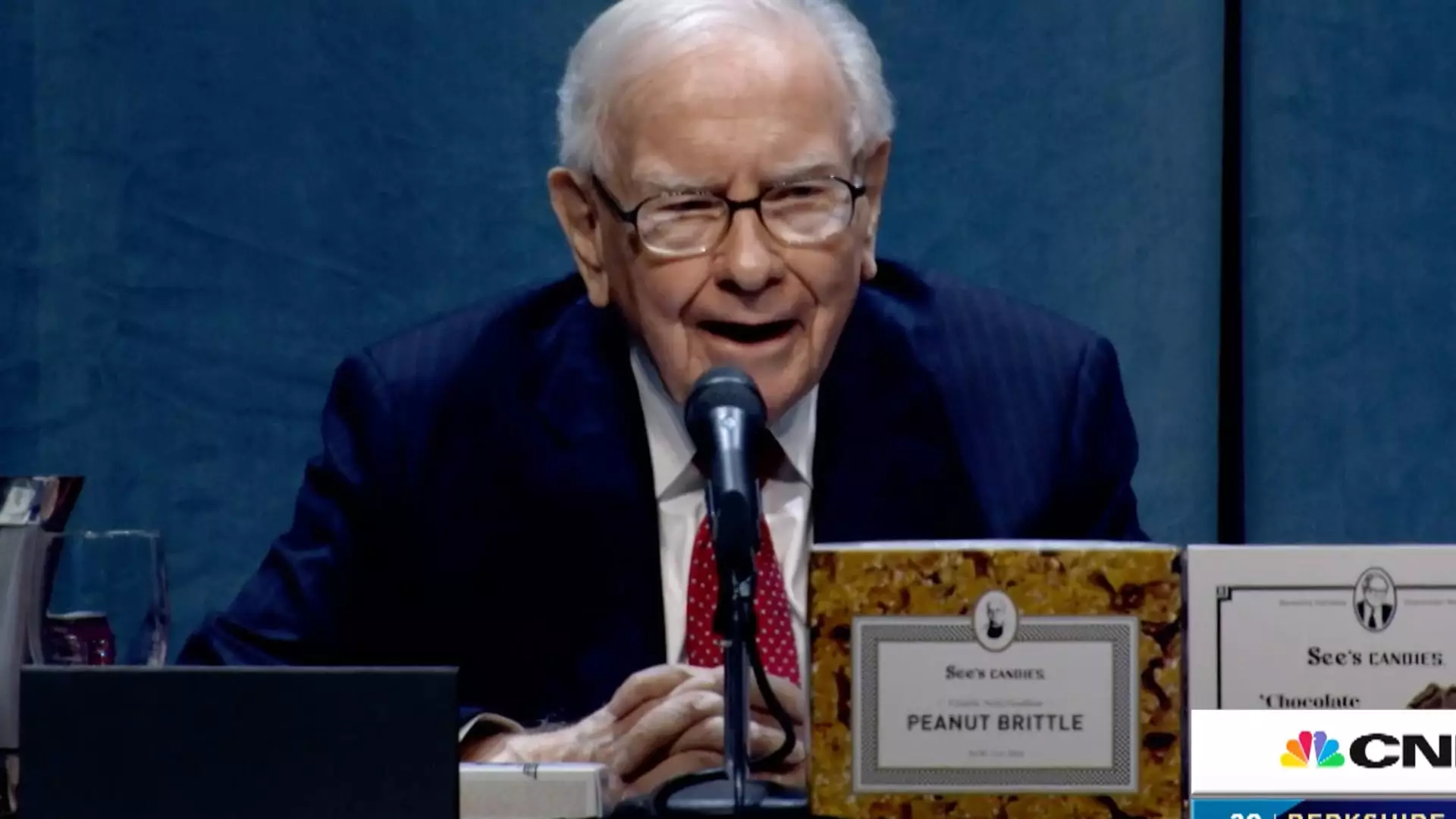

Warren Buffett, the renowned CEO of Berkshire Hathaway, is rarely one to delve into political discourse, especially when it comes to the complexities of trade policy. However, in a recent interview, he shed light on President Donald Trump’s tariffs, warning that such measures could lead to inflationary pressures which would adversely affect consumers. His remarks serve not only as critiques of specific policies but also as broader insights into the economic implications of tariffs.

Buffett’s commentary points to a long-standing economic principle that tariffs are essentially a form of taxation on consumers. With a light-hearted yet poignant statement, he quipped, “The Tooth Fairy doesn’t pay ’em!” This highlights the fact that tariffs imposed on imported goods typically result in higher prices for consumers, who bear the cost of these punitive duties. Such a perspective is crucial to understanding the often overlooked consequences of trade wars, which can have far-reaching effects on the economy.

His analogy of tariffs being akin to an “act of war” underscores the severity of their implications. History shows that trade wars can escalate into broader economic conflicts that hinder growth and disrupt market stability. By framing tariffs in this way, Buffett emphasizes the need for cautious deliberation in trade policy.

The implications of Trump’s tariffs are further complicated by the dynamics of international trade. With the announcement of a 25% tariff on imports from Mexico and Canada, and an additional 10% on China, the potential for retaliatory measures raises significant concerns. Trade partners have historically responded to tariffs with their own, leading to a tit-for-tat strategy that can spiral out of control.

Buffett’s historical caution regarding aggressive trade policy aligns with his current investment strategy, which has seen him divest from stocks at an unprecedented pace, accumulating cash reserves. This defensive posture has left analysts divided: some see it as a bearish indicator for the economy, while others interpret it as a preparation for a transition of power to his eventual successor.

Despite declining to comment on the present economic conditions during his CBS interview, Buffett acknowledged their complexity. As concerns about a slowing economy, heightened market volatility, and fluctuating policy decisions swirl, investors are left navigating a precarious landscape. The recent performance of the S&P 500, which has only seen a modest rise of about 1% this year, signifies the uncertainty permeating the market.

Buffett’s cautious transparency illuminates the challenges facing investors amid transitioning economic policies. His insights prompt a broader discourse on the impact of political maneuvering on economic stability, a reminder that at its core, the financial market thrives on predictability—a commodity often in short supply.

Warren Buffett’s reflections on tariffs reveal the inherent risks associated with aggressive trade policies and their potential to culminate in inflation and consumer burden. As we stand at a crossroads in economic policy, it becomes increasingly essential for leaders to weigh the implications of their decisions not just domestically but globally. In a world interconnected by trade, the movements of one country can resonate across the globe, illustrating that economic warfare can be just as damaging as the physical kind. While Buffett’s commentary is a cautionary tale, it also serves as a call for strategic thinking in pursuit of enduring economic prosperity.