SoftBank’s recent announcement of investing $2 billion into Intel might appear, on the surface, as a bold move to inject much-needed confidence into a sinking ship. However, beneath the veneer of optimism lies a stark reality: this investment is unlikely to be a game-changer for Intel’s beleaguered trajectory. For a conglomerate of SoftBank’s stature—once a pioneer in the tech and investment sectors—this appears more as a desperate attempt to stabilize a company that has been hamstrung by strategic missteps and an inability to capitalize on burgeoning tech trends like artificial intelligence. The choice of paying a slightly discounted price per share signals acknowledgment of Intel’s troubled waters, yet it also underscores the frustration and cautious optimism surrounding the chipmaker’s future.

Intel’s Chronic Troubles and the Fragile Foundation

Since the sharp decline in its stock value last year—losing a staggering 60%—Intel has been mired in structural struggles. Despite being a historical titan in the semiconductor industry, Intel’s failure to rapidly adapt to the AI boom has been glaring. Numerous billions poured into developing a foundry business have yet to produce tangible results or gain critical mass with major clients. The company’s challenge isn’t merely about technological capability; it’s about strategic vision, timely execution, and regaining trust from the industry and investors alike. The recent stock rebound of 18% in 2025 might suggest optimism, but it remains a fragile rally rooted more in speculative hope than in firm fundamentals.

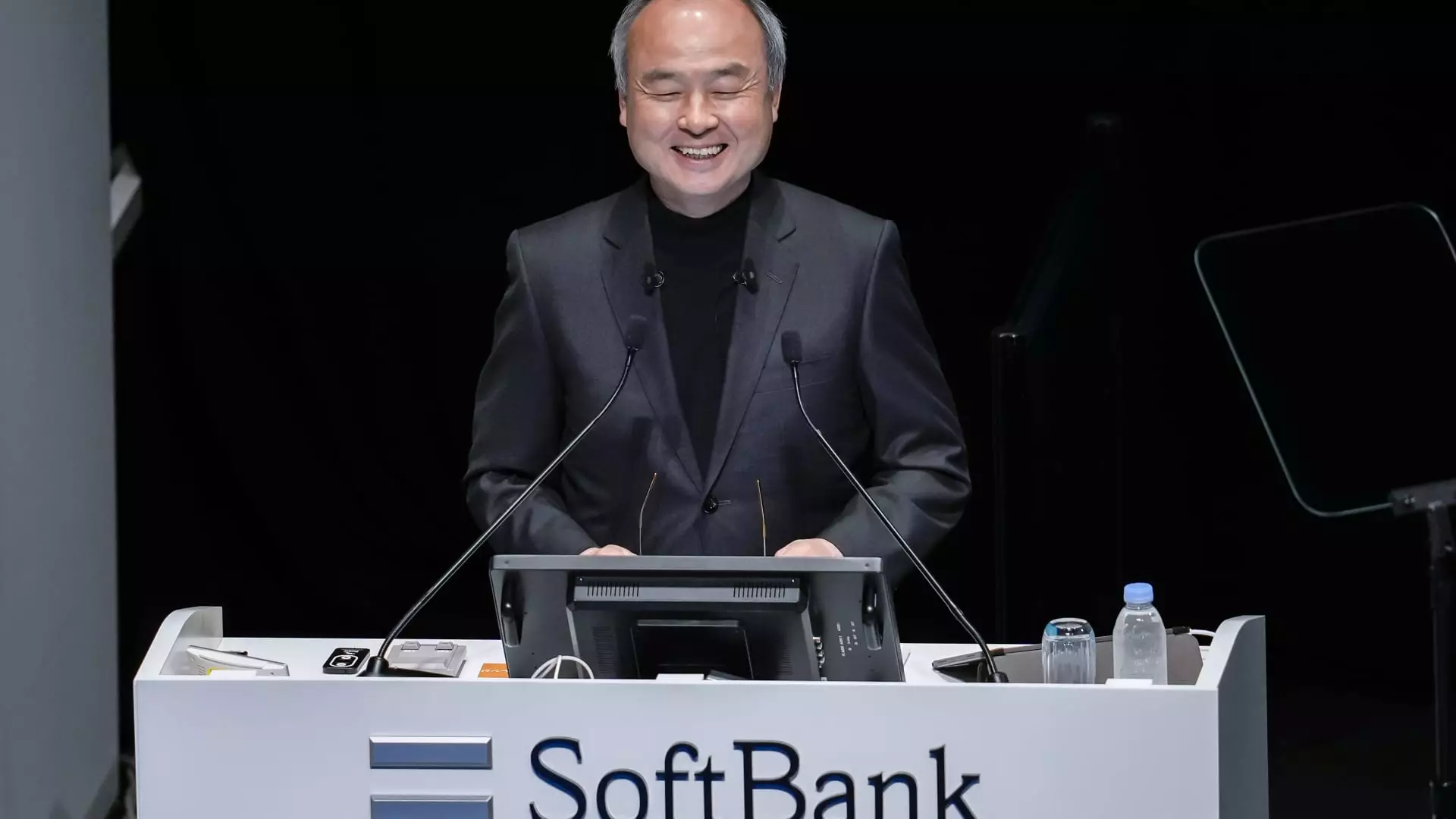

SoftBank’s Motives and Strategic Positioning

SoftBank’s investment should not be viewed purely as philanthropy or an altruistic rescue effort. Rather, it’s a calculated move to position itself more prominently within the global chip and AI markets. SoftBank’s history of large-scale acquisitions—Arm, Ampere Computing, and its ventures into AI infrastructure—highlight a broader ambition to shape the future of advanced computing. By becoming Intel’s fifth-largest shareholder, SoftBank gains strategic influence over a company pivotal to U.S. dominance in chip manufacturing. It’s a subtle assertion that amidst geopolitical tensions, the U.S. remains vital in defining the next era of tech dominance, and SoftBank wants a stake in that future.

The Political and Geopolitical Dimensions

Intel’s pivotal role in American technological sovereignty has made it a target of political scrutiny, particularly in Washington’s push to bolster domestic chip manufacturing. The U.S. government’s contemplation of taking an equity stake in Intel underscores the nation’s urgency to secure its supply chains and innovation edge. SoftBank’s investment aligns with this vision, subtly signaling that private sector initiatives are integral to national strategic goals. Yet, this also exposes Intel’s vulnerabilities—its reliance on government support and its shaky status as a domestic manufacturing leader. The recent high-profile meetings with political figures, including President Trump, highlight the volatile intersection of tech, geopolitics, and economics, where Intel is increasingly caught in the crossfire.

Challenges Beyond the Financials

The core issue with Intel isn’t solely about financial valuation or share prices. It’s about time lost, strategic mismanagement, and a failure to innovate rapidly enough. Its foundry ambitions are crucial but remain unfulfilled—an unfulfilled promise that continues to haunt its future prospects. The industry’s shift toward AI-centric architectures and specialized chips demands agility and foresight that Intel has struggled to demonstrate. Meanwhile, SoftBank’s backing, though providing a cushion, does little to extricate Intel from its cycle of stagnation. This investment, in essence, might serve more as a symbolic gesture than a substantive solution to Intel’s deeper issues.

The Illusion of Revival in a Changing Landscape

While SoftBank’s intervention might momentarily buoy sentiment, it risks engendering false hope. The semiconductor industry is hyper-competitive, requiring relentless innovation, strategic partnerships, and a clear focus—none of which Intel has convincingly achieved recently. The industry’s new champions, like Nvidia and emerging foundries, have outpaced Intel by embracing AI and custom chip solutions more effectively. As a result, Intel’s attempt at a comeback feels more like a rearguard action, holding onto past glories rather than attacking future opportunities. SoftBank’s sizeable investment, though commendable, cannot substitute for the fundamental reforms and renewed strategic clarity that Intel desperately needs to reclaim its former stature.