In a surprising move, Federal Reserve Governor Stephen Miran publicly diverged from the consensus, advocating for a much more aggressive monetary policy adjustment than his colleagues. While the majority of the Federal Open Market Committee (FOMC) opted for a modest quarter-point rate cut, Miran pushed for a half-point reduction, signaling a different economic outlook. This dissent, coming shortly after his Senate-confirmed appointment, underscores the tension within the traditionally cautious institution, especially when one considers his rapid leap to a more dovish position—a move that raises questions about his underlying economic philosophy and loyalties.

Miran’s stance is particularly notable given his recent ascendancy to the Fed board, a position that often signifies alignment with prevailing monetary policy trends. His call for a significantly steeper rate cut suggests a more aggressive approach to invigorating economic activity or possibly a belief that current policy risks falling behind a rapidly changing economic landscape. Such divergence indicates an internal rift, or at least a confrontation with the cautious consensus, that could reshape the committee’s future decision-making dynamics.

Political Influences and the Impact on Central Bank Independence

Miran’s appointment, orchestrated during Donald Trump’s presidency, has infused political considerations into the traditionally insulated realm of monetary policy. Critics argue that his fast-tracked confirmation and willingness to advocate for a more aggressive policy shift serve a broader political agenda, potentially undermining the Federal Reserve’s independence. The president’s vocal desire for even lower rates—calling for reductions of two to three percentage points—reinforces fears that monetary policy is increasingly subject to political influence rather than objective economic analysis.

This politicization threatens the delicate balance that the Fed has historically maintained. When cabinet appointments or influential members adopt stances aligned with particular political narratives, it risks eroding the credibility and impartiality that underpin monetary stability. Miran’s dissent, in this context, becomes less about economic strategy and more a reflection of the broader tug-of-war between executive influence and central bank independence. If policymakers start to prioritize political objectives over economic realities, it could lead to unpredictable market reactions and long-term instability.

The Disconnect Between the Market and Policy Expectations

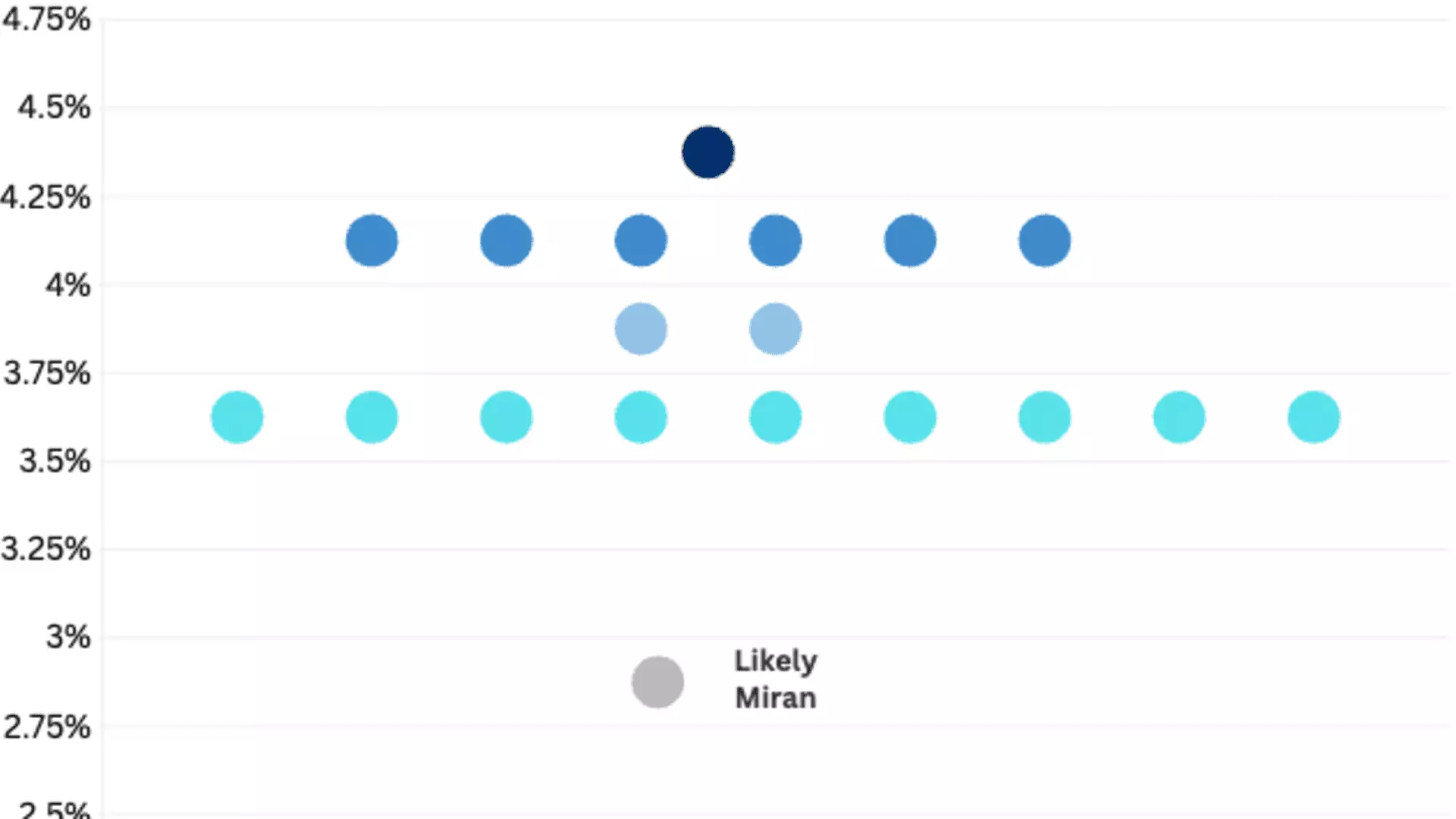

The growing divergence among Fed officials—highlighted by the “dots” in their rate projections—exposes an internal discord that unsettles investors and markets. Miran’s advocacy for more aggressive cuts contrasts sharply with most members’ outlooks, which envisage limited reductions into 2025 and 2026. The wide range of anticipated rate cuts in the future underscores the uncertainty in the Fed’s trajectory and creates a climate of unpredictability.

Investors, always keen to interpret signals from the Fed, may see Miran’s dissent as a harbinger of more tumultuous monetary policy shifts ahead. His stance feeds into an unsettling narrative: the central bank is increasingly fragmented in its approach, leaving markets to grapple with inconsistent guidance. This discord not only complicates investment and business decisions but also fuels speculation about potential political interference—particularly given Miran’s connection to the Trump administration.

The underlying question remains: Is Miran’s bold dissent rooted in legitimate economic concerns or is it a sign of a centrally driven effort to sway policy toward a particular agenda? His call for much steeper cuts suggests optimism about the economy’s resilience, but it also undermines the cautious tone the Fed has historically maintained. Such a divergence fosters uncertainty—a sentiment that ultimately hampers long-term economic planning and stability.

The Broader Implications for Federal Reserve Governance

Miran’s aggressive stance comes at a time when the Fed’s independence is under increased scrutiny. His appointment, coupled with Trump’s overt attempts to influence the Fed’s leadership, signals a shift toward a more political approach to monetary policy. The fact that he plans to assume a temporary, unpaid role as Chair of the White House’s Council of Economic Advisers complicates matters further, as it blurs the lines between policy advisory and central banking responsibilities.

Critics argue that this environment incentivizes Fed members to adopt more populist, politically palatable positions rather than sticking to cautious economic analysis. The risk is that policymaking becomes reactive and polarization intensifies, ultimately damaging long-term credibility. The situation is reminiscent of an institution caught between technocratic independence and political expediency, and Miran’s dissent could be a symptom of an internal struggle that may redefine central banking for years to come.

With the Fed facing external pressures from a political climate eager for aggressive rate cuts and economic stimulus, Miran’s stance might serve as either a brave stand for economic integrity or a reckless gamble driven by political motives. Regardless, it exposes the fragility of the current system and the pressing need for clear boundaries between politics and monetary policy to prevent future destabilization.