The Consumer Financial Protection Bureau (CFPB) has recently found itself at a critical crossroads, as directives from newly appointed officials and changes in operational protocols raise significant questions about the agency’s purpose and future. An internal memo indicated that employees would work remotely until February 14, emphasizing the sudden and drastic measures taken amid what appears to be a hostile takeover by external influences. This article delves into the implications of these changes and explores the precarious position of the CFPB in the current political landscape.

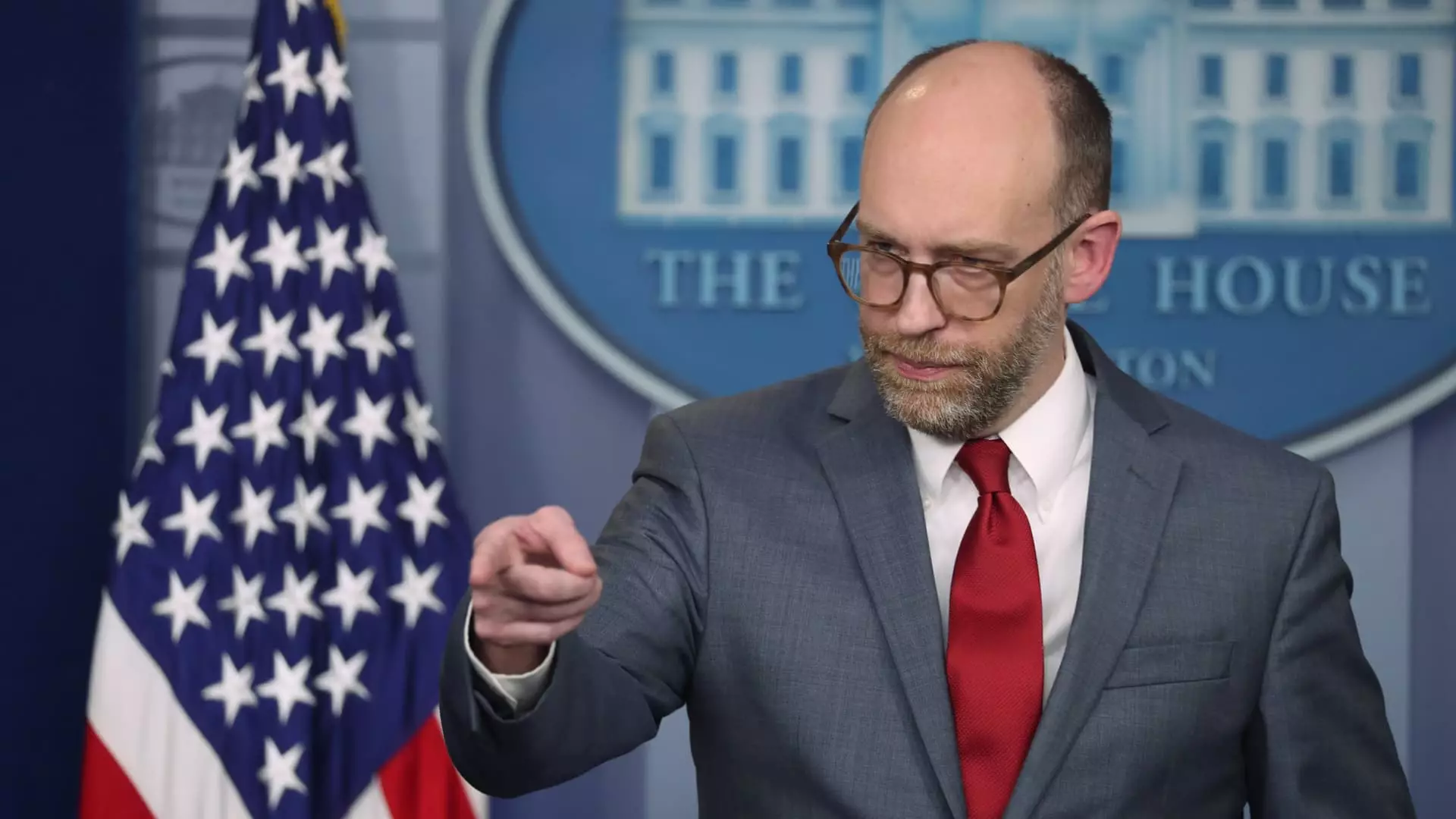

On a January weekend, CFPB Chief Operating Officer Adam Martinez issued a memo prompting employees to work from home, a decision reflecting an unusual shift for an agency typically committed to on-site engagement. The abrupt closure of the Washington D.C. headquarters follows an earlier message from acting CFPB director Russell Vought, who ordered a suspension of nearly all regulatory activities, including the supervision of financial institutions. Such sweeping changes have sparked anxiety among employees, who speculate that this could lead to broader administrative measures, potentially putting their jobs at risk.

The decision to go remote raises serious questions about the operational capability of the CFPB during a time when consumer financial protections are more crucial than ever. The agency, formed in response to the 2008 financial crisis, has been instrumental in enforcing rules aimed at preventing unfair practices in the financial sector. The buildup of uncertainty could hinder its ability to fulfill its mandate, thereby jeopardizing consumer protections that have been hard-won.

The recent involvement of operatives from Elon Musk’s initiative, known as DOGE, adds another layer of complexity to the situation. Reports have surfaced indicating that these external employees gained access to sensitive CFPB data, including staff performance evaluations. The presence of DOGE operatives has reignited concerns over the integrity and autonomy of the CFPB as an independent regulatory body.

Musk’s public sentiment towards the CFPB has been hostile, having previously called for the agency’s dissolution. His recent social media activity, including the provocative post stating “CFPB RIP,” has stirred a cocktail of fear and uncertainty among CFPB staff. The potential implications of having external actors participate in internal agency operations cannot be overlooked. The CFPB’s core mission — protecting consumers from financial exploitation — now faces unprecedented challenges amid the intrusion of an influential private sector figure such as Musk.

In light of the recent announcements, CFPB employees are preparing for the possibility of administrative leave or layoffs, similar to prior attempts made by Trump administration officials to dismantle government agencies. The specter of budget cuts raised by Vought’s comment about halting fresh funding to the CFPB could further destabilize an agency already under pressure. With approximately 1,700 employees, only a fraction are mandated by law to exist. Consequently, mass layoffs could seriously undermine the agency’s operational capacity and mission.

The specter of economic hardship looms large, particularly as the CFPB has several ongoing efforts designed to save American consumers billions of dollars. These include regulations aimed at curbing unreasonably high credit card fees and eliminating certain medical debts from credit reports. The loss of these initiatives, coupled with the diminished workforce, would not merely entail job losses but would resonate profoundly with consumers striving for financial fairness in an increasingly complex economic environment.

The shifting landscape of the CFPB calls into question the long-term sustainability of consumer protections initiated in the wake of the Great Recession. As the agency navigates political pressures and financial constraints, its very existence seems jeopardized. Bank lobbyists have consistently accused the CFPB of overreach, and this moment could serve as a pivotal chapter in their ongoing battle against regulatory frameworks designed to protect consumers.

If the CFPB loses its operational effectiveness, consumers could find themselves vulnerable to exploitative financial practices once again. The stakes are high, and the forthcoming decisions concerning the future of the CFPB will undoubtedly have lasting repercussions on the American financial landscape. As the situation develops, stakeholders must remain vigilant and advocate for the continued protection of consumer interests in the face of evolving challenges.