In recent months, discussions surrounding inflation have shifted toward a critical component—rent. A report from the Federal Reserve Bank of Cleveland highlights a pressing issue: rent inflation is expected to stay elevated, posing significant challenges for the Federal Reserve’s objective of bringing overall inflation down to the target rate of 2%. Cleveland Fed economists predict that rent inflation will not revert to the pre-pandemic norm of approximately 3.5% until mid-2026. This expectation is paramount as it shapes economic policy and consumer sentiment in an environment already strained by rising costs.

Rent, a substantial part of household expenditure, has become a focal point in inflationary concerns. The current imbalance between new rental contracts and existing leases is a critical factor contributing to rent inflation. Analysts suggest that while new rentals have experienced considerable hikes, those increases have yet to fully integrate into the rent charged for existing tenants. This gap in rental increases, currently sitting around 5.5%, illustrates a potential surge in ongoing rent costs that could exacerbate financial pressures on consumers.

The Federal Reserve’s strategy to combat post-pandemic inflation has primarily targeted monetary policy adjustments. Officials are optimistic that inflation can revert to the desired rate, having initiated a series of rate cuts that aim to stabilize economic growth. However, the persistence of rent inflation complicates this narrative. Even as overall inflation appears to decrease, shelter costs remain a stubborn fixture driving the inflation metrics. Rent inflation’s “stickiness” indicates that it might persist longer than other inflation components, thereby complicating the Fed’s efforts.

In comparison to the overall inflation rate, which has shown signs of easing, rent growth has decelerated yet remains elevated. According to research, annualized rent growth for 2023 has typically hovered around 4.6%, down from 6.8% in prior estimates. This reduction indicates a slight alleviation in affordability pressures, yet many households continue to feel the squeeze. Fed representatives, including those from the St. Louis Fed, have expressed hope that declining rent inflation will gradually ease the burdens on overall price indices, allowing the Fed to steer the economy back toward its inflation targets.

While the Federal Reserve and economists maintain a cautiously optimistic outlook, several variables contribute to the uncertainty surrounding future rent trends. The ongoing shifts in employment and wage growth are pivotal. With a cooling labor market, the urgency for landlords to hike rents may diminish, potentially allowing existing tenants a respite. However, the economic landscape is complex, and factors such as supply chain disruptions and changes in homeowner sentiment can inadvertently affect rental markets.

Experts like Susan Collins, president of the Boston Fed, have underscored that the inflationary pressures linked to shelter rental prices are multifaceted. The current surge in rents reflects not only market dynamics but also the lag between new market conditions and the prices felt by existing tenants. As new rent hikes begin to stabilize, projections suggest that existing rental agreements will likely adapt to reflect these broader trends, leading to a gradual normalization of rental costs.

Implications for Consumers and Policy-Makers

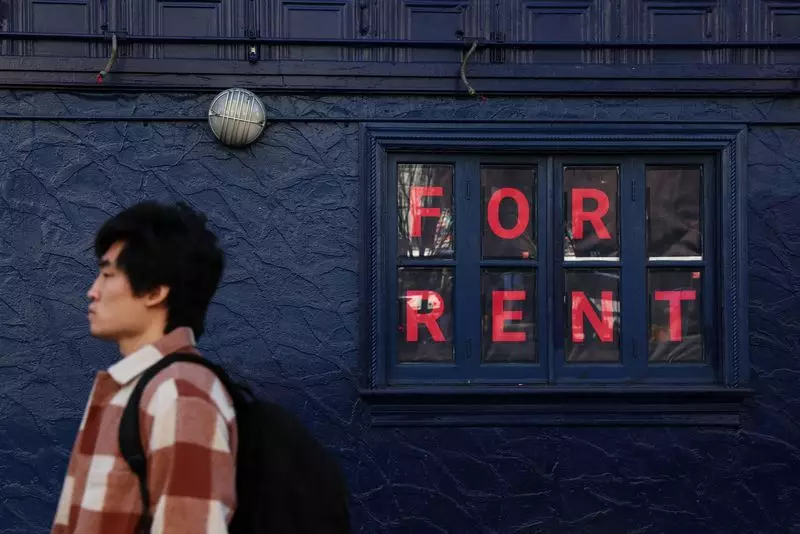

For consumers, the sustained pace of rent inflation portends ongoing challenges. Many households are already grappling with increased living costs, and a drawn-out period of high rent could erode disposable income further, affecting spending power and overall economic health. This situation calls for vigilance from policymakers, who must consider the social ramifications of prolonged inflation in essential areas like housing.

While the Federal Reserve aims to navigate the path back to a 2% inflation goal, the complexities of rent inflation introduce hurdles that require multifaceted approaches. It is imperative for stakeholders, including consumers and policymakers, to stay informed and agile in their strategies, as the trajectory of rent costs will significantly impact the broader economic landscape in the coming years. The dialogue surrounding rent inflation is not merely an economic issue; it is a fundamental concern affecting the daily lives of millions, and comprehensive solutions will be essential to ensure economic resilience and stability.