In the rapidly evolving landscape of digital finance, the issue of fraud has become increasingly critical. Recently, British fintech company Revolut has made headlines by directly addressing Facebook’s parent company, Meta, regarding its insufficient measures to combat fraud on its social media platforms. This bold stance is particularly noteworthy in light of a recent data-sharing initiative announced by Meta in partnership with U.K. banks, including NatWest and Metro Bank, aimed at preventing fraud. However, Revolut’s critique raises vital questions about responsibility and liability in the digital age.

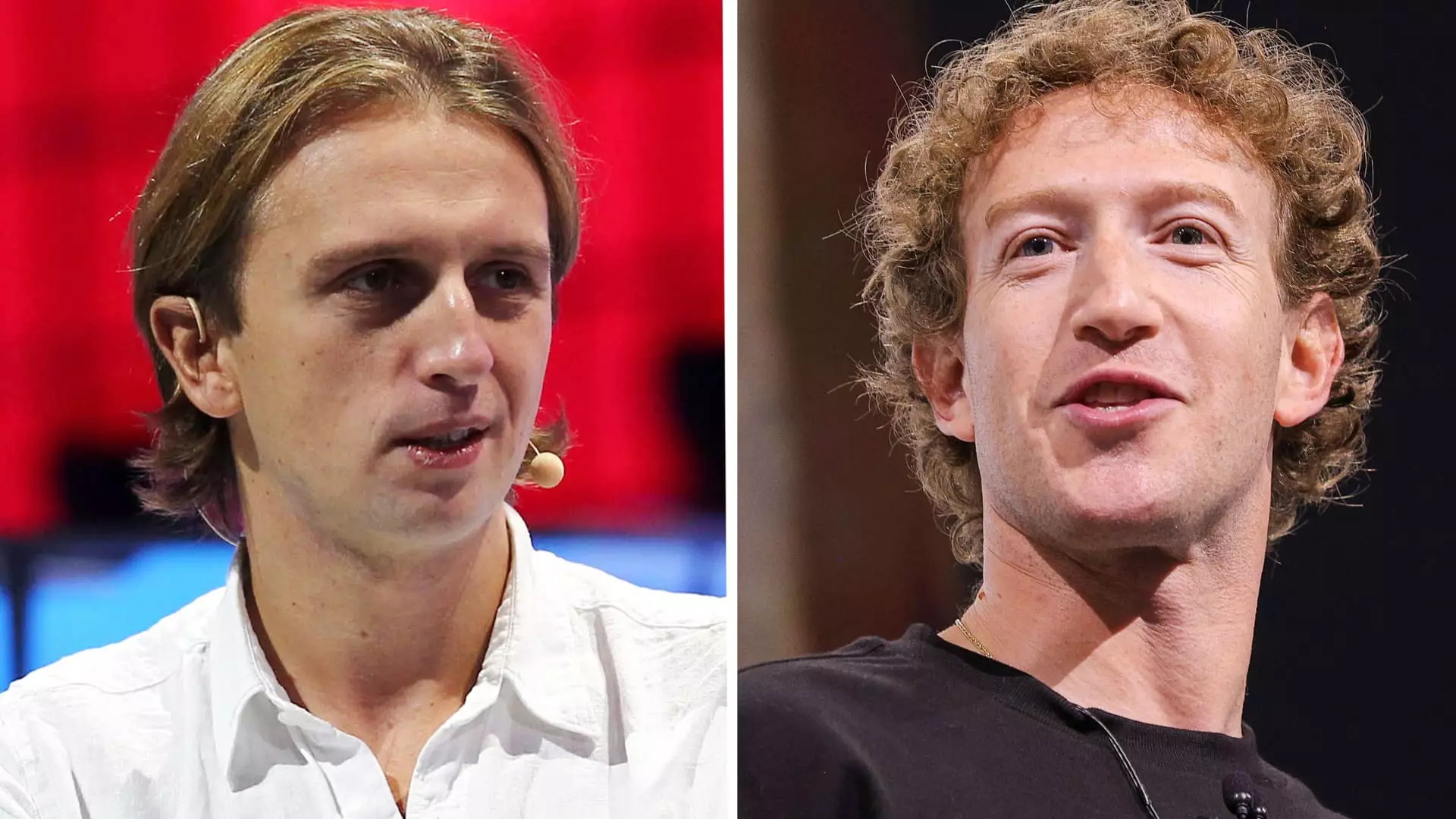

Revolut has issued a strong condemnation of the newly established partnership between Meta and U.K. banks, labeling it as inadequate in the larger fight against fraud. Woody Malouf, Revolut’s head of financial crime, succinctly pointed out that the efforts presented by Meta are merely “baby steps” when the industry urgently requires “giant leaps forward.” This metaphor indicates a deep frustration with the status quo and a desire for substantial changes that address the complexities of digital fraud.

One key point in Revolut’s argument is the lack of accountability from platforms like Meta. As social media giants are increasingly recognized as conduits for fraudulent activities, the expectation that they should bear some responsibility becomes a critical discussion point. Malouf noted that these platforms currently do not provide any financial reimbursement to victims of scams that transpire on their sites. This underscores the notion that without direct accountability, Meta and similar companies lack motivation to implement genuinely effective protective measures.

Upcoming reforms in the U.K. payment industry, effective from October 7, further illuminate the need for accountability within tech companies. These reforms will compel banks and payment firms to offer a maximum compensation of £85,000 ($111,000) to victims of authorized push payment (APP) fraud. While this legislation highlights a significant step towards protecting consumers, the limitations evident in its implementation reveal deeper systemic issues. Notably, the Payments System Regulator had initially proposed a higher compensation cap of £415,000, only to retract this following pressure from banks.

Revolut’s perspective reflects a broader industry concern that, although the government is making commendable efforts to combat fraud, these measures are still insufficient as long as social media platforms continue to escape their share of the responsibility. The disjunction between government action and corporate accountability raises ethical questions about the roles these influential tech entities play in safeguarding their users.

To genuinely tackle the growing incidence of digital fraud, a paradigm shift is needed in how social media companies approach their responsibilities. Revolut’s insistence on direct compensation for fraud victims represents a call for reinvigorated corporate accountability that aligns more closely with consumers’ needs. In a world where identity theft and financial crimes are on the rise, consumers deserve robust protections that extend beyond mere data-sharing agreements.

As Revolut critiques Meta’s response to fraud, it opens up an essential dialogue about the expected roles of tech companies in an increasingly digital society. Both public policy and corporate strategies must evolve concurrently to create a safer online environment where victims are protected and held in higher regard. Only through collective responsibility can we hope to mitigate the persistent threat of digital fraud effectively.