As the race for satellite-based internet services heats up globally, China finds itself facing a monumental challenge: catching up with SpaceX’s dominant Starlink. With nearly 7,000 operational satellites currently orbiting Earth and a customer base exceeding five million in over 100 countries, SpaceX has set a formidable benchmark. The objective of Starlink, beyond merely providing internet access, is to connect individuals in remote and underserved locations, a mission that resonates deeply with the demand for high-speed connectivity in many regions of the world. To further solidify its presence, SpaceX has ambitious plans to scale its megaconstellation to a staggering 42,000 satellites, reinforcing its commitment to being a leader in this emerging sector.

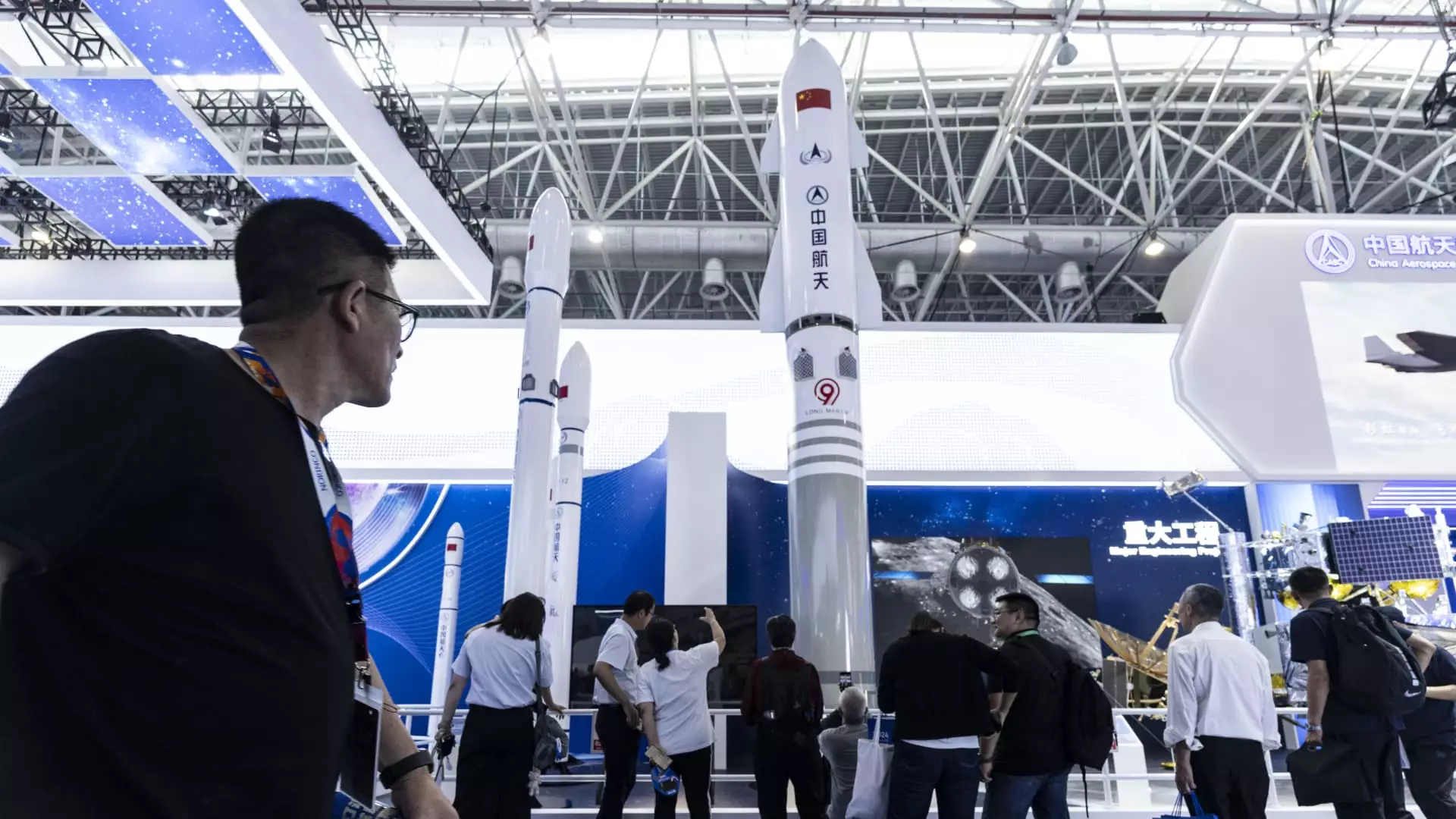

In response to SpaceX’s lead, China has unveiled plans for a comparable endeavor, aiming to deploy approximately 38,000 satellites across its three major low Earth orbit (LEO) internet projects: Qianfan, Guo Wang, and Honghu-3. This drive for an extensive satellite network raises questions about the motivations behind China’s significant investments. In a competitive landscape that includes established players like European-based Eutelsat OneWeb and upcoming giants like Amazon with its Project Kuiper, what strategy does China hope to adopt to carve out its own niche?

The geopolitical ramifications of satellite internet cannot be understated, especially considering the potential threat posed by uncensored internet access. According to experts, Starlink’s ability to provide unfiltered information can undermine state-controlled narratives and censorship regimes. Steve Feldstein, a senior fellow at the Carnegie Endowment for International Peace, highlights that for a nation like China, enabling uncensored internet access could disrupt its rigorous censorship efforts. This poses a unique dilemma: China faces the threat of Starlink delivering unregulated content to its citizens and to allied nations, which contrasts sharply with its own efforts to control information within its borders.

Blaine Curcio, founder of Orbital Gateway Consulting, emphasizes that this presents an opportunity for China. While they may lag behind in terms of speed to market, the ability to offer a censored internet solution for various countries could differentiate China’s services from competitors like Starlink. In essence, China can market itself as a provider that takes into account the political desires of nations that require strict information control.

While the likelihood that Chinese satellite services will become primary internet providers in the United States or Western Europe is slim, many emerging markets could be receptive to what China has to offer. There are numerous regions where Starlink has yet to establish a foothold—countries like Russia, Afghanistan, Syria, and significant swathes of Africa remain largely unserviced by current satellite internet providers.

As Juliana Suess from the German Institute for International and Security Affairs points out, given China’s existing telecom investments—specifically the 70% of the 4G infrastructure built by Huawei across Africa—it stands to reason that a satellite internet offering could further solidify China’s economic and political ties within the continent. For regions where traditional internet infrastructure is lacking, these new satellite capabilities could be seen as a vital asset.

The establishment of proprietary satellite internet constellations is increasingly being perceived not merely as a commercial venture but also as a national security imperative. As evidenced in recent conflicts, such as the ongoing war in Ukraine, satellite technology has emerged as a game-changer, enabling sophisticated connected warfare strategies. For military operations that rely heavily on real-time communications and drone warfare, a seamless internet connection can offer a distinct strategic advantage over adversaries.

Thus, for China, the stakes go beyond mere internet provision; entering the LEO satellite market is intrinsically linked to national defense and global influence. As global competition intensifies, the outcomes of these endeavors will have lasting implications not just for internet accessibility but for the balance of geopolitical power in the years to come. In this high-stakes game, every satellite launched will serve as both a symbol of technological prowess and a potential weapon in the larger struggle for global dominance.