The stock market is a dynamic landscape, constantly shifting in response to news, earnings reports, and economic forecasts. In this article, we will take a closer look at several companies making headlines during midday trading, providing an analysis of their stock movements and underlying factors driving these changes.

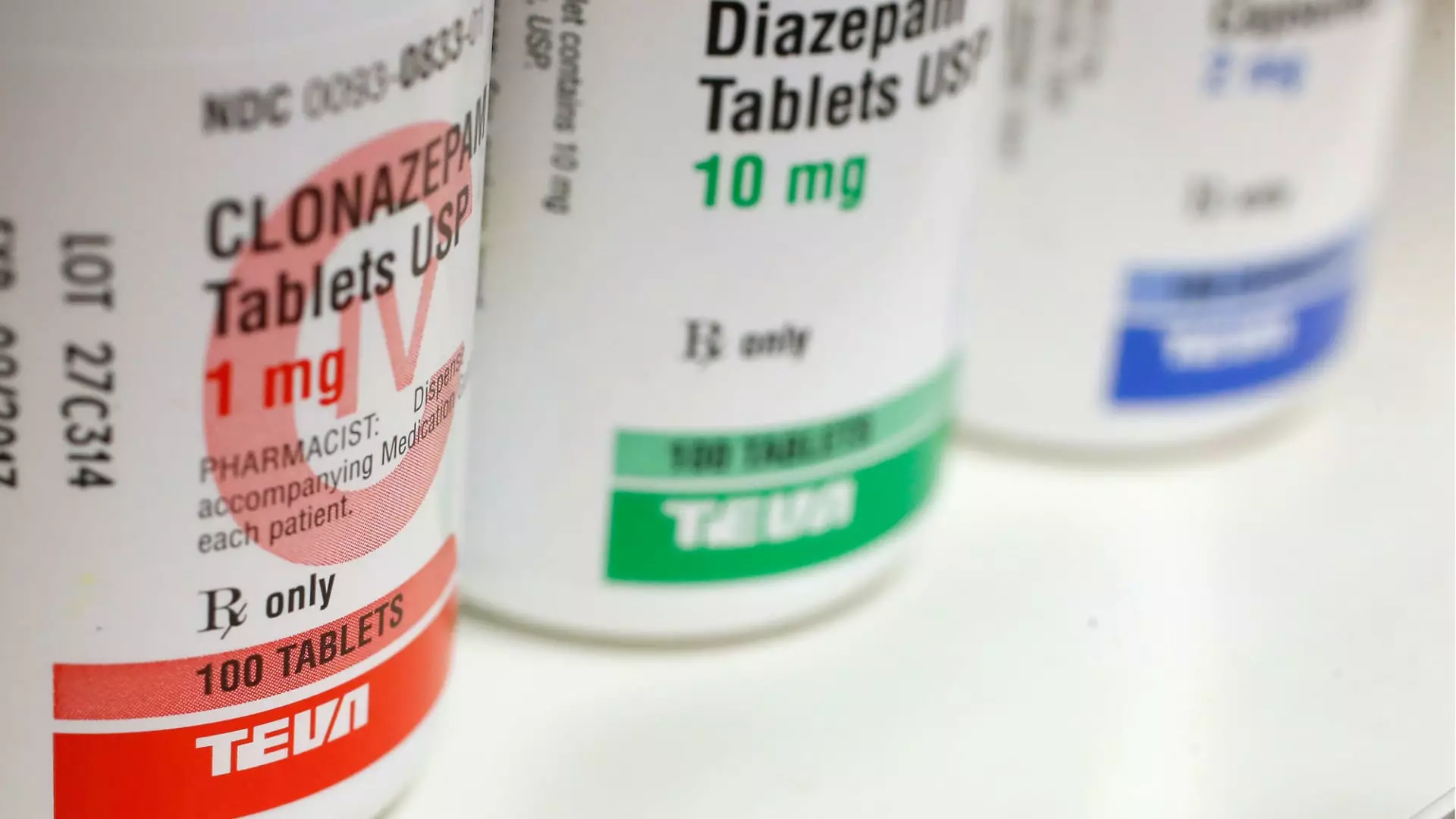

Teva Pharmaceuticals and Sanofi are two stalwarts of the pharmaceutical industry that recently reported groundbreaking Phase 2b results for duvakitug, a treatment aimed at moderate to severe inflammatory bowel disease. Following this announcement, Teva’s shares surged over 23%, while Sanofi saw an increase of around 6%. This significant appreciation in share value underscores the market’s optimistic outlook on the potential of duvakitug, possibly positioning it as a leading option in a critical treatment landscape. The impressive results not only indicate a step forward in addressing a challenging health issue but also emphasize the potential for subsequent financial success for both companies if the treatment proceeds through further stages of development successfully.

Pfizer’s Steady Forecast Amidst Market Volatility

Amid a fluctuating market, Pfizer’s recent guidance for 2025 has been received positively, resulting in a 4% rise in their stock price. The company projected revenue figures between $61 billion and $64 billion, harmonizing with Wall Street’s consensus estimate of $63.22 billion. This alignment suggests stability within Pfizer’s operations and a robust pipeline, reassuring investors in an industry often susceptible to market swings. Given Pfizer’s prominent role in vaccine production and other pharmaceutical advancements, its positive forecast may also indicate a greater resilience that could defy broader market downturns.

Quantum Computing Breakthroughs Fuel Investor Enthusiasm

One of the standout performers in midday trading was Quantum Computing, whose stock surged over 38% after being awarded a prime contract by NASA’s Goddard Space Flight Center. The contract entailed supporting NASA’s advanced imaging and data processing needs with the company’s Dirac-3 quantum optimization machine. This partnership not only highlights the growing importance of quantum technology in real-world applications but also positions Quantum Computing as a key player in an emerging sector. The significant stock spike reflects investors’ optimism about the role of advanced computing technologies in future innovations and government-supported projects.

In the clean energy space, SolarEdge Technologies experienced a remarkable 21% increase in its stock value following a favorable double upgrade by Goldman Sachs from sell to buy. The bank’s analysts suggested that 2025 would mark a pivotal moment for SolarEdge, hinting at a strategic turnaround fueled by its investments in renewable technologies. This endorsement from a reputable financial institution illustrates not only confidence in the company’s projects but also indicates a broader societal shift towards investing in sustainable solutions, enhancing the validity of the predicted inflection point.

Challenges for Red Cat and Amentum Holdings

Conversely, not all companies are enjoying positive market reactions. Red Cat, a player in the drone technology arena, saw its shares tumble 12% after posting a fiscal second-quarter loss greater than analysts anticipated. Despite a brief rally tied to sensational drone sightings, the company ultimately presented discouraging financial results. Similarly, Amentum Holdings faced significant declines, dropping 12% after revealing a quarterly pro forma loss, starkly contrasting with the previous year’s profitability. These cases highlight the volatility and unpredictability that can accompany growth industries, where hype does not always translate to solid financial performance.

The Rollercoaster of Chip Stocks: Nvidia and Broadcom

Nvidia and Broadcom, two behemoths in the semiconductor industry, also made headlines. Nvidia’s shares fell over 1% as the stock entered correction territory, reflecting market pressures following prior gains. Meanwhile, Broadcom saw an almost 5% dip despite posting better-than-expected quarterly earnings, which had previously propelled its market capitalization above $1 trillion. This dichotomy in performance perfectly encapsulates the inherent volatility in technology stocks, where investor sentiment can rapidly turn in reaction to both positive and negative stimuli.

The midday trading scene showcases a blend of triumphs and setbacks across various sectors. While companies like Teva, Sanofi, and Quantum Computing are enjoying significant gains due to groundbreaking developments and partnerships, others like Red Cat and Amentum must navigate the repercussions of disappointing financial disclosures. As sectors strive to innovate and evolve, investors must remain vigilant, evaluating not just immediate market trends but also the fundamental factors that drive long-term success. In the intricate dance of the stock market, understanding these nuances is crucial for making informed investment decisions.