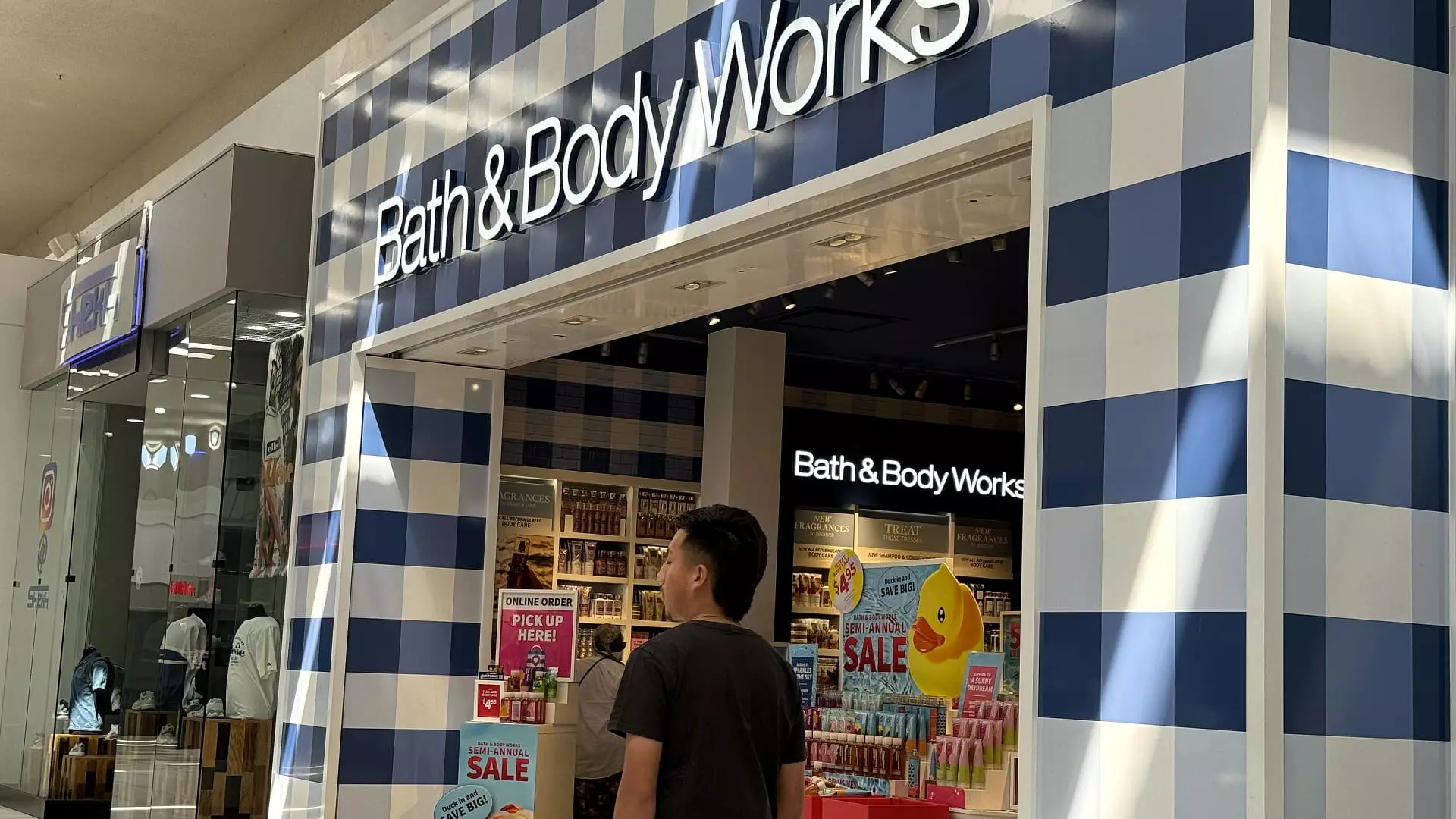

In the competitive landscape of retail, Bath & Body Works has made a significant mark with its recent financial results. The company experienced a remarkable 16% surge in its stock price after reporting third-quarter earnings that exceeded analysts’ expectations. The retailer’s earnings reached 49 cents per share on revenues of $1.61 billion. Analysts had predicted a slightly lower earnings figure of 47 cents from $1.58 billion in revenue. This outperformance not only showcases the company’s effective strategies in a challenging market but also indicates strong consumer demand for their products, particularly as the holidays approach.

The brokerage firm Robinhood is also making headlines, with its shares rising over 7% following a rating upgrade by Morgan Stanley. The investment firm lifted its outlook to overweight, citing expectations of increased revenue growth post-election. This projection is based on anticipated heightened trading activity in stocks and potential deregulation in the cryptocurrency market. Investors seem optimistic about Robinhood’s ability to capitalize on these developments, reflecting a broader confidence in the platform’s long-term strategy.

In stark contrast, Macy’s has exhibited volatility with a 3% decline in its stock following unsettling news regarding its accounting practices. The company has postponed releasing its official third-quarter earnings due to the discovery of intentional accounting inaccuracies by an employee, which concealed delivery expenses amounting to between $132 million and $154 million over several years. Although the retailer reassured investors that the cash position remains unaffected, this incident raises questions about corporate governance and internal controls, which could impact investor trust in the long run.

Investors are looking forward to Abercrombie & Fitch’s third-quarter earnings, expected to be released soon. Ahead of this announcement, shares rose by 3%. Analysts forecast earnings of $2.39 per share, with anticipated revenues of $1.19 billion. Positive sentiments in the broader retail sector have contributed to Abercrombie’s stock performance, especially following the uplifting outlook from competitor Gap, which reflects a robust start to the holiday shopping season. This anticipation suggests that market dynamics are favoring well-positioned retailers.

Meanwhile, Target’s shares saw a nearly 2% uptick, aided by an upgrade from Oppenheimer, which cited improved risk-to-reward metrics. Despite a year-to-date stock decline of about 12%, analysts pointed out the attractiveness of Target’s dividend yield as a significant factor for investors. This endorsement from Oppenheimer may change the trajectory of Target’s stock as it attracts attention in a market that has grown increasingly discerning.

MicroStrategy, focusing on Bitcoin investments, saw its stock price increase by 3% after Bernstein raised its price target significantly, reflecting enthusiasm for its growth potential amid a booming cryptocurrency market. Additionally, Sally Beauty Holdings experienced a rise of nearly 3% following an upgrade from TD Cowen, which pointed out the company’s robust free cash flow and appealing valuation. These movements indicate a positive outlook for companies strategically positioned within their sectors.

Lastly, Banco Santander’s stock gained 2% thanks to a similar upgrade from Morgan Stanley, which identified the bank’s resilience in capital generation as a key strength. This highlights the broader confidence in the financial sector as it navigates economic challenges while showing signs of stability and growth.

The premarket trading landscape is notably influenced by corporate financial performance, upgrades, and market perceptions. As we observe these developments, it becomes clear that investors are navigating a complex array of factors influencing their decisions in the current economic climate.