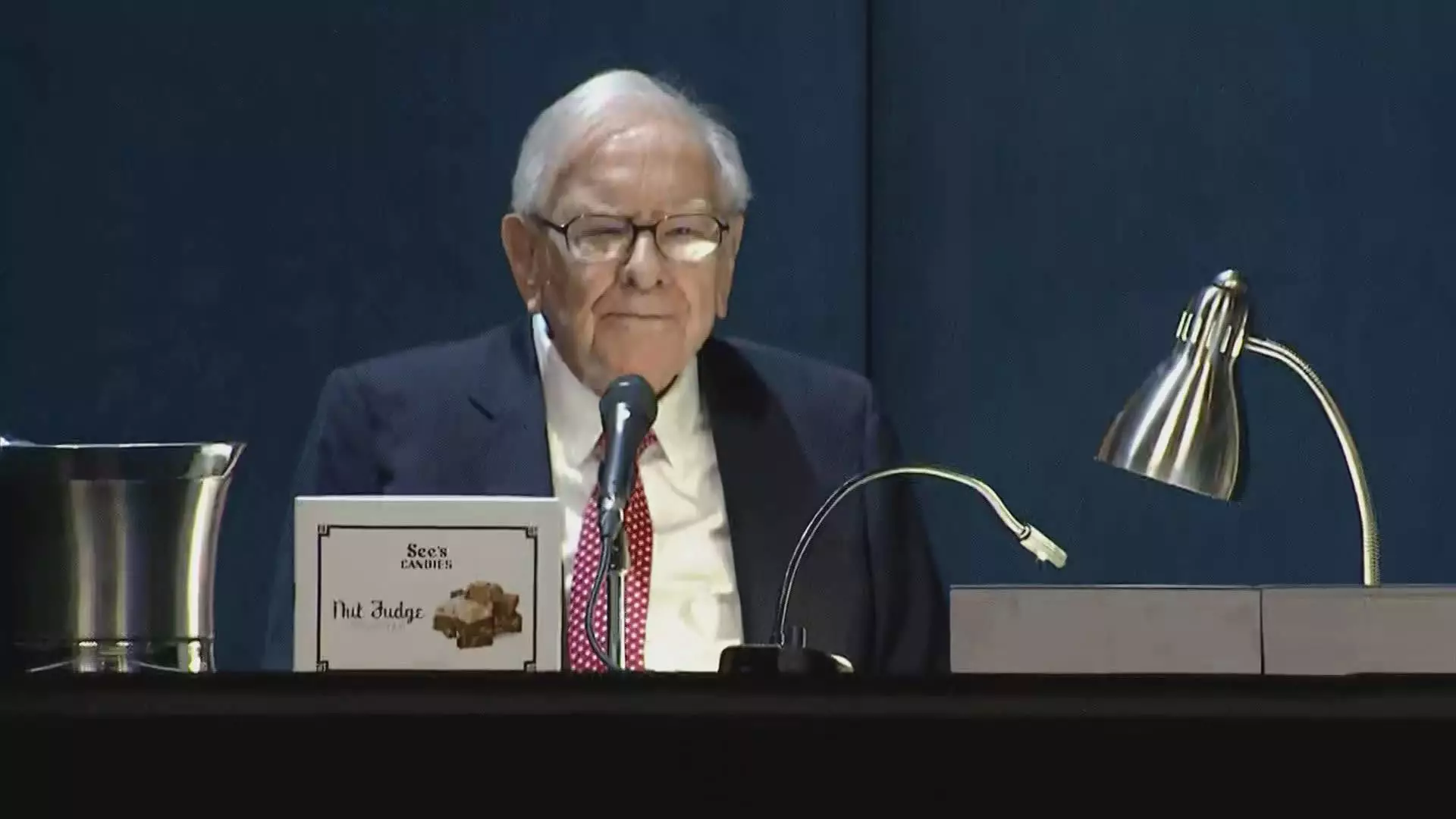

Warren Buffett, the revered chairman and CEO of Berkshire Hathaway, has made headlines once again as he continues to substantially trim his investment in Apple Inc. This move marks the fourth consecutive quarter in which Berkshire has reduced its stake in the tech giant. As of the latest third-quarter earnings report, the Omaha-based firm held approximately $69.9 billion in Apple shares, revealing that Buffett has divested nearly a quarter of his total holding, which now stands at around 300 million shares.

Buffett’s relationship with Apple has evolved significantly since he first invested in the company over eight years ago. Originally hesitant to venture into the tech industry, Buffett shifted his strategy after being influenced by his investing lieutenants, Ted Weschler and Todd Combs. The attraction to Apple stemmed from its loyal customer base and the unmatched stickiness of its products, particularly the iPhone. At its zenith, Apple’s representation in Berkshire’s equity portfolio was so substantial that it accounted for 50% of the entire portfolio.

Despite the initial enthusiasm for Apple, the rationale behind Buffett’s recent selling spree remains slightly ambiguous. Analysts have speculated that multiple factors may be contributing to this decision. High stock valuations appear to be a significant concern, as shareholders question the sustainability of Apple’s meteoric rise. Moreover, the trend of reducing concentration in a single investment might be an overarching strategy to mitigate risk.

Buffett himself hinted during the annual Berkshire meeting that tax implications could also be influencing his decisions. The possibility of increased capital gains taxation in response to a rising fiscal deficit has made Buffett cautious. His aim might be to optimize his tax position before any potential hikes take effect.

Interestingly, while divesting from a dominant position in Apple, Berkshire Hathaway’s cash reserves have soared to a record high of $325.2 billion. This stark contrast raises questions about where the funds will be allocated. The company paused its buyback program during the quarter, which may suggest that Buffett is strategically biding his time, looking for the right opportunities to reallocate resources.

Ultimately, Warren Buffett’s decision to sell off a substantial portion of his Apple stock indicates a significant strategic pivot within Berkshire Hathaway. Whether driven by concerns over current market valuations, future tax liabilities, or the need to maintain a diversified investment portfolio, this choice reflects a broader trend of prudence and adaptability. With Apple shares appreciating by 16% this year—still trailing the S&P 500’s 20% rebound—Buffett’s next moves will undoubtedly be closely monitored by investors and analysts alike. The renowned investor’s knack for navigating market challenges will be put to the test as he seeks to balance profitability with risk management in an increasingly complex economic environment.