The music industry operates in a dynamic and ever-evolving landscape where trends shift quickly, affecting artists, platforms, and the companies that manage the intricacies of music rights. One company making significant strides in this field is Reservoir Media, a music rights collector and publisher with a diverse portfolio. This article aims to explore Reservoir Media’s operational segments, financial performance, and potential future, given the current climate of investment and partnership dynamics within the music publishing realm.

Reservoir Media has developed a nuanced business model comprising two principal segments: Music Publishing and Recorded Music. The Music Publishing segment serves as the backbone of the company’s revenue streams through the acquisition and management of music catalogs. This includes both signing songwriters and earning royalties from established works. Reservoir’s catalog boasts compositions from iconic artists like Joni Mitchell and John Denver, showcasing a strategy focused on rock-solid intellectual property that has historically maintained a loyal audience.

On the other hand, the Recorded Music segment complements this approach by engaging with sound recording catalogs and scouting new talents. The importance of this segment has escalated in an age where digital consumption drives trends, leading to a notable 21.66% year-over-year growth. Together, these domains represent more than 95% of Reservoir’s revenue, indicating a robust and strategically diversified operational framework that caters to both established legacies and emerging talent.

Financial Performance: Navigating Challenges and Opportunities

Despite a promising trajectory marked by year-on-year growth in gross profit—where figures climbed from $47.39 million to $89.38 million—Reservoir’s financial landscape is not without obstacles. The company has suffered a significant drop in share price, experiencing a loss of about 22.24% since its public debut. This troubling trend raises questions about investor sentiment and broader market conditions.

Despite these challenges, Reservoir Media’s revenue model is buoyed by the ongoing rise of subscription streaming services, which saw an industry-wide growth of 11.2% in 2023. Presently, streaming and downloading contribute approximately 54.17% of the company’s overall revenue, underscoring the significance of this trend. The fact that the music industry increasingly leans toward digital platforms accentuates the importance of sustained investment and audience engagement strategies to fortify revenue channels.

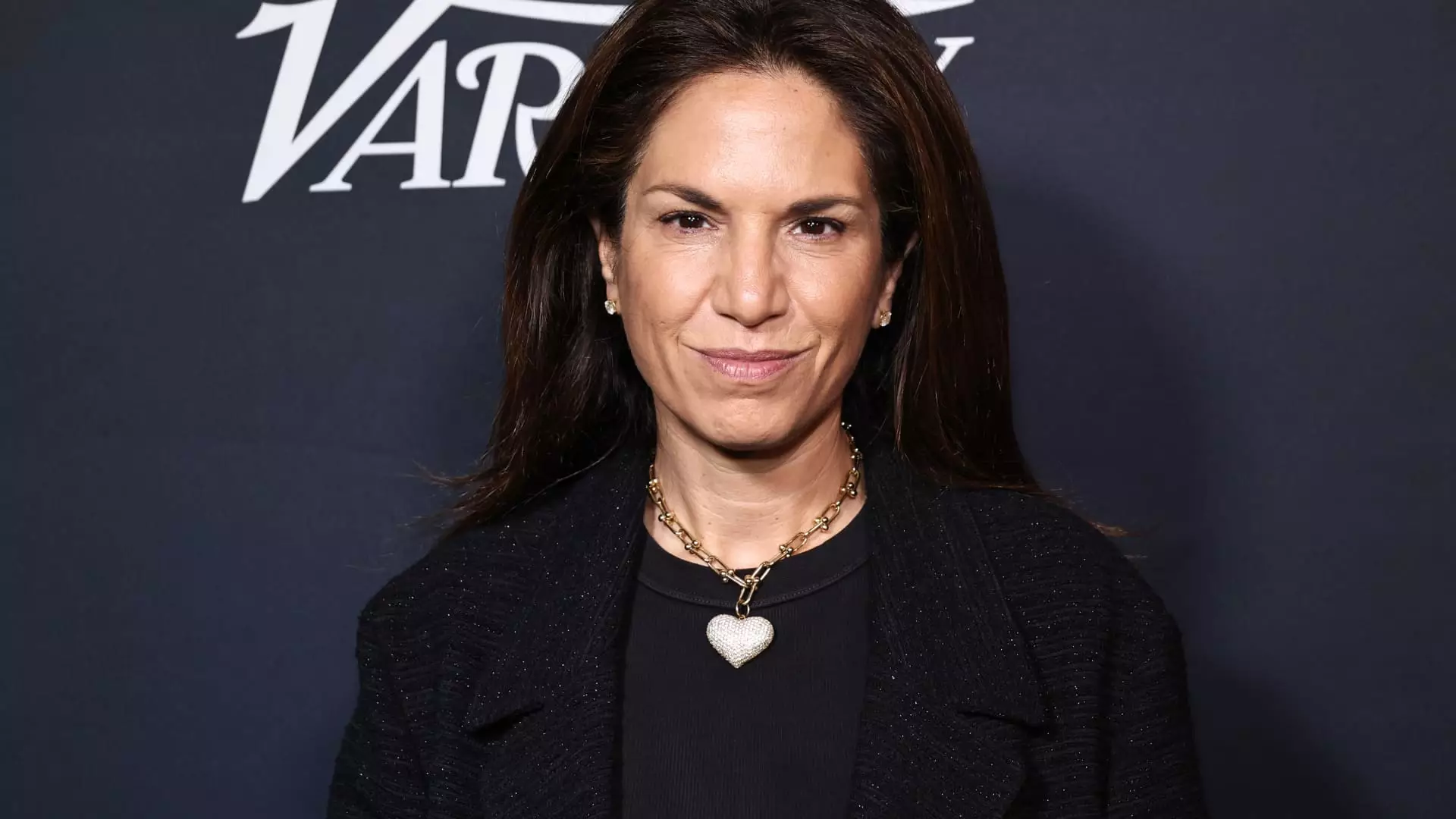

Another layer of complexity is added by the involvement of activist investment firms like Irenic Capital, which have begun to engage with Reservoir Media’s leadership. Founded by experienced investors, Irenic has raised alarms regarding the strategic direction of the company. The firm’s recent advocacy for a comprehensive review and potential sale of Reservoir’s assets hints at underlying concerns regarding the public company structure in a highly volatile market.

While the push for ‘sell the company’ activism might attract criticism, there are circumstances where such strategies could lead to beneficial outcomes. In Reservoir’s situation, characterized by its function as a passive collector of royalty revenues, the call for strategic review encapsulates an awareness that the company might fare better in the hands of a private entity able to leverage the assets more efficiently away from public scrutiny.

The Future Outlook: Mergers, Acquisitions, and Strategic Partnerships

The question of acquisition looms large over Reservoir Media. Given its established catalog and reputable management team, the company stands as an attractive target for buyers, be they strategic or financial. The current landscape suggests potential interest from private equity firms eager to optimize the value of the company’s music rights. A recent precedent is set by the acquisition of peer competitor Hipgnosis, which sold at a substantial premium relative to its revenues.

Importantly, any potential shift in ownership would likely require the cooperation of loyal stakeholders, including the Khosrowshahi family, who maintain a significant stake in the company. Their continued presence, especially in leadership roles, could eliminate fears of upheaval while fostering a seamless transition for Reservoir’s assets.

In summation, while Reservoir Media operates under a solid business structure that capitalizes on stable music revenues and digital streaming growth, its future hangs in the balance amid fluctuating share prices and potential activist maneuvers. The brands represented in its catalog collectively offer a legacy that could attract buyers, affording the company opportunities to align itself with strategic partners. As the music industry continues to evolve, Reservoir’s ability to adapt and optimize its assets will ultimately define its trajectory in an ever-competitive arena. The coming years could very well determine whether Reservoir Media becomes a benchmark for resilience in the music rights market or a cautionary tale of lost potential.