Grabango, a once-promising startup in the realm of cashierless checkout solutions, recently shuttered its operations after failing to secure the necessary funding to continue viable business practices. The company, founded in 2016 in Berkeley, California, aimed to revolutionize the shopping experience by deploying advanced technologies like machine learning and computer vision. These tools were designed to track items in real time, streamlining the checkout process by allowing customers to take products off the shelf without needing to interact with a cashier. Despite making strides and gaining recognition in the grocery and convenience store sectors, Grabango’s aspirations ultimately crumbled under the weight of financial constraints.

Technological Innovation and Market Position

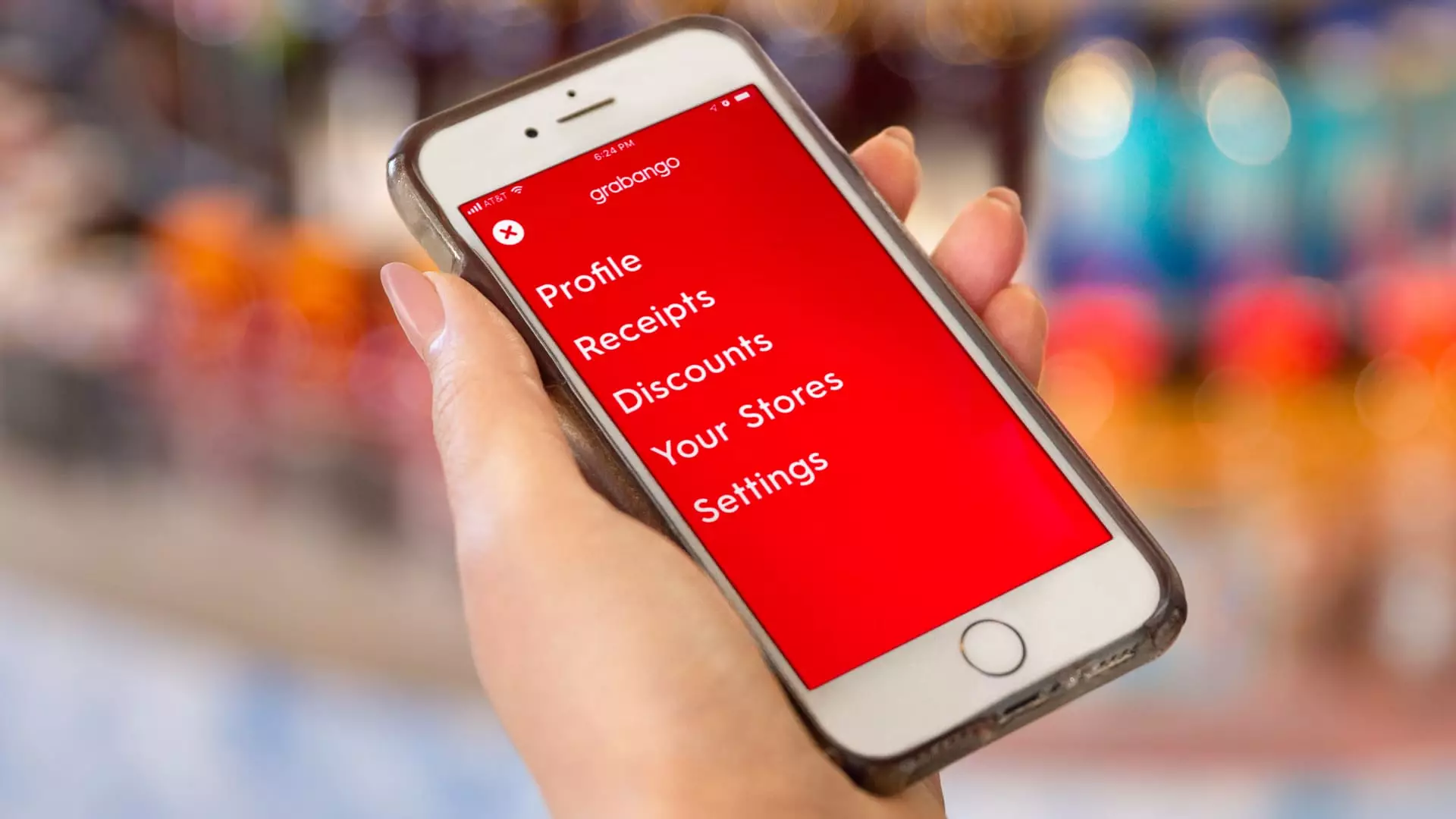

Grabango was not merely a participant in the race for cashierless technology; it emerged as a pioneer. The firm sought to offer an alternative to Amazon’s Just Walk Out service, which was geared toward enhancing customer convenience in retail settings such as airports and convenience stores. The technology deployed by Grabango aimed to provide retailers with a seamless shopping experience, leveraging robust algorithms to accurately count items and process transactions as customers moved through aisles.

Co-founder Will Glaser, a notable figure in the tech industry known for co-founding Pandora, envisioned a future where checkout-free shopping became commonplace. Grabango’s partnerships with major grocery chains like Aldi and Giant Eagle hinted at significant traction within the market. The firm represented a burgeoning ecosystem of startups—such as AiFi and Trigo—that sought to bring cashierless experiences to mainstream retail.

Despite these promising developments, the financial landscape acted as a formidable barrier. Grabango raised approximately $73 million over several funding rounds, peaking with a substantial $39 million infusion in 2021. This funding was propelled by well-known investors, including Peter Thiel’s Founders Fund. However, it soon became evident that the startup was unable to pivot quickly enough to secure additional investment as economic conditions began to shift.

After the peak of 2021, venture capital endeavors began to wane, particularly in sectors outside of AI. The soaring interest rates and tightening liquidity made it increasingly difficult for many startups, including Grabango, to sustain their operations. Glaser’s ambitious statements regarding a potential IPO and valuation in the multi-billion dollar range now seem like fleeting aspirations rather than viable business goals.

The closure of Grabango signals a cautionary tale for other startups within the tech landscape. The trajectory of Grabango illustrates the volatile nature of venture-backed businesses, especially in rapidly changing industries. The company’s struggle to secure funding despite proven technology stresses the importance of adaptability in both product development and market strategy.

While the company’s technological innovations set them apart, their inability to navigate economic downturns speaks volumes about the risks startups face. The evolving preferences of consumers for frictionless shopping experiences will undoubtedly continue to fuel interest in cashierless technologies. However, the lessons from Grabango’s abrupt end serve as a reminder that innovation must go hand-in-hand with strategic financial planning and resource management.

Looking forward, the competitive landscape in cashierless checkout technology remains dynamic, with giants like Amazon continuing to dominate due to their substantial resources and market reach. However, the strategy employed by Grabango, which involved eschewing reliance on shelf sensors, remains noteworthy and may pave the way for future innovators who can learn from Grabango’s challenges.

Continuous advancements will emerge in this domain, guided by lessons learned from both failures and successes. As new entrants in the sector begin their journeys, they would do well to take note of Grabango’s trajectory, preparing themselves to navigate the complexities of funding, market dynamics, and technological viability in a fast-evolving retail space. The tale of Grabango may be one of loss, but it also serves as a beacon for those who dare to innovate amidst obstacles in the journey toward creating consumer-friendly technology solutions.