Tesla’s recent foray into the robotaxi market, highlighted by the unveiling of the Cybercab concept, marked a significant event for the electric vehicle industry. However, despite the anticipation that surrounded this event, investor reactions were far from enthusiastic. Tesla’s stock took a notable dive following the event, signaling a disconnect between Musk’s expansive vision and palpable investor expectations. This incident raises critical questions about direction, transparency, and sustainability in Tesla’s pursuit of autonomy.

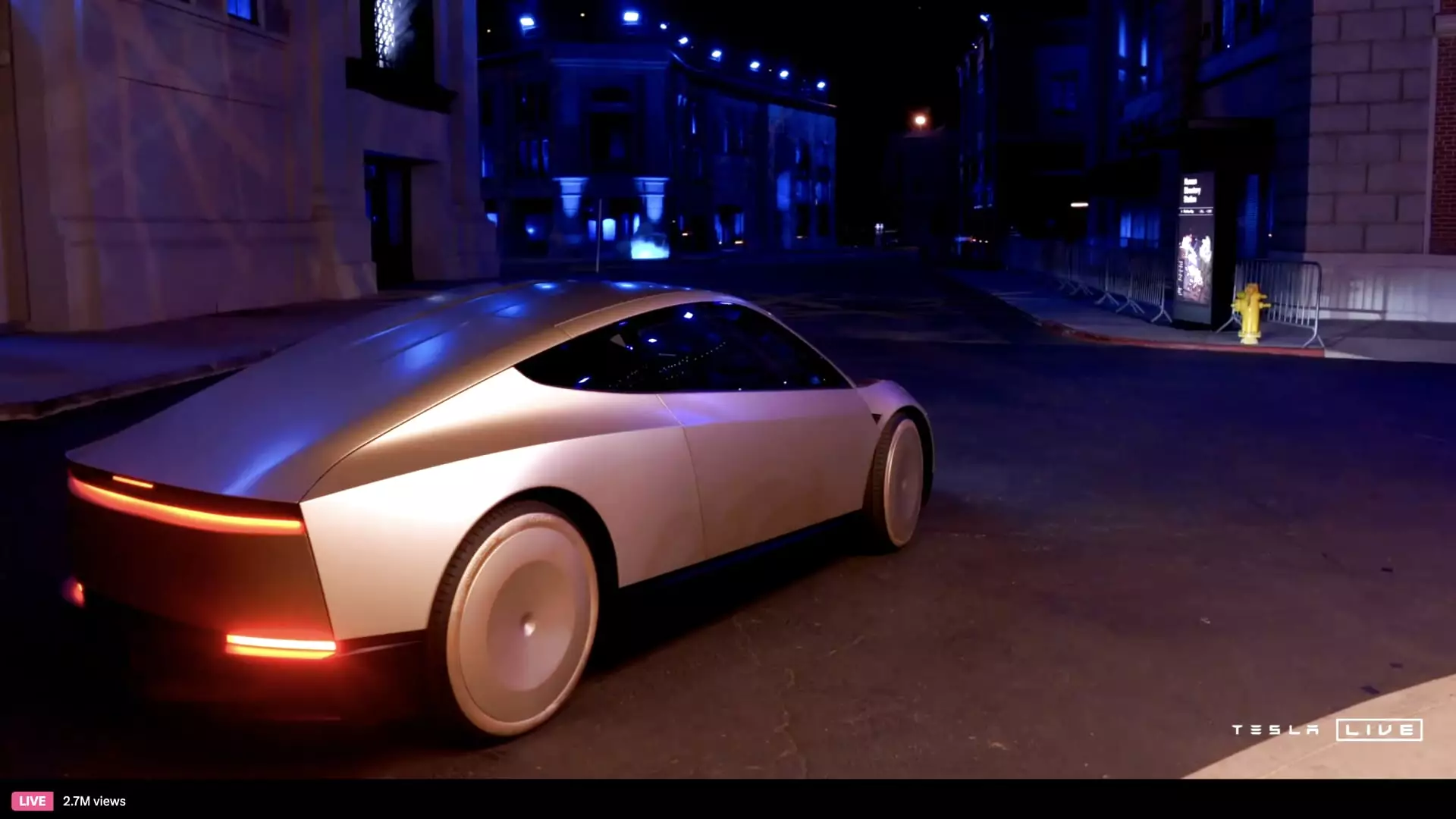

Elon Musk introduced the Cybercab as a futuristic solution for urban transport, a concept devoid of traditional driving elements like steering wheels and pedals. Its design is sleek, aimed at capturing a new market of passengers seeking autonomous transportation. Priced at an impressive target of under $30,000, initiation of production is slated for before 2027. However, there remains an unsettling ambiguity surrounding its manufacturing process and logistical deployment, issues that investors find concerning in an environment where clarity is invaluable.

Significantly, the Cybercab is positioned as a fully autonomous vehicle, yet investors remain uncertain about the technological foundations that support its proposed capabilities. Musk’s assertions about the timeline for achieving “unsupervised FSD” (Full Self-Driving) capabilities in Texas and California only add to these concerns. Current iterations of Tesla’s FSD system still require human oversight, which raises skepticism regarding the technological leap being proposed.

As the dust settled from the event, analysts from significant financial institutions expressed critical assessments of the unveiling. Barclays criticized the lack of immediate opportunities highlighted during the presentation, pointing out that the focus was heavily tilted towards grand visions rather than tangible, executable plans. Their analysis suggests that investors were expecting updates on near-term advancements that could hint at profitability but were met with vagueness.

Piper Sandler’s commentary mirrored this sentiment, predicting a decline in Tesla’s stock in the aftermath of what they described as a lackluster presentation. The word “underwhelmed” surfaced frequently in analyses, indicating that investors were hoping for a transformative announcement that could bolster confidence in Tesla’s autonomy strategy. Yet, the absence of concrete data on FSD improvements or economic viability of the proposed robo-taxi model left many in the financial community dissatisfied.

The task of introducing self-driving vehicles onto public roads is fraught with regulatory challenges. Governments worldwide are cautious about the safety implications of autonomous technology, and this skepticism only compounds investor unease. While companies like Waymo are making strides with operational robotaxis, Tesla must contend with proving safety and reliability first, ensuring that regulatory bodies and potential consumers alike have trust in the technology.

Moreover, the recent event did little to position Tesla as a leader in AI innovation, as highlighted by Morgan Stanley analysts who scrutinized the dearth of specifics relating to FSD advancements and strategic partnerships. The absence of a clear narrative linking Tesla’s robotics ambitions to AI capabilities could undermine investor confidence in the company’s broader technological prowess.

As Tesla stands at this critical juncture, it must address fundamental challenges to harness the potential of its ambitious visions. The Cybercab could represent a groundbreaking shift in urban transportation; however, the lack of clarity regarding its implementation, technological sophistication, and regulatory acceptance raises eyebrows. Investors are wary, and the mixed sentiments reflected in stock performance indicate that the journey to widespread adoption of autonomous vehicles may be longer and more intricate than Musk’s vision suggests. Tesla must prioritize transparency and practical progress to convert speculation into conviction, if it hopes to emerge successfully in the rapidly evolving landscape of electric and autonomous vehicles.