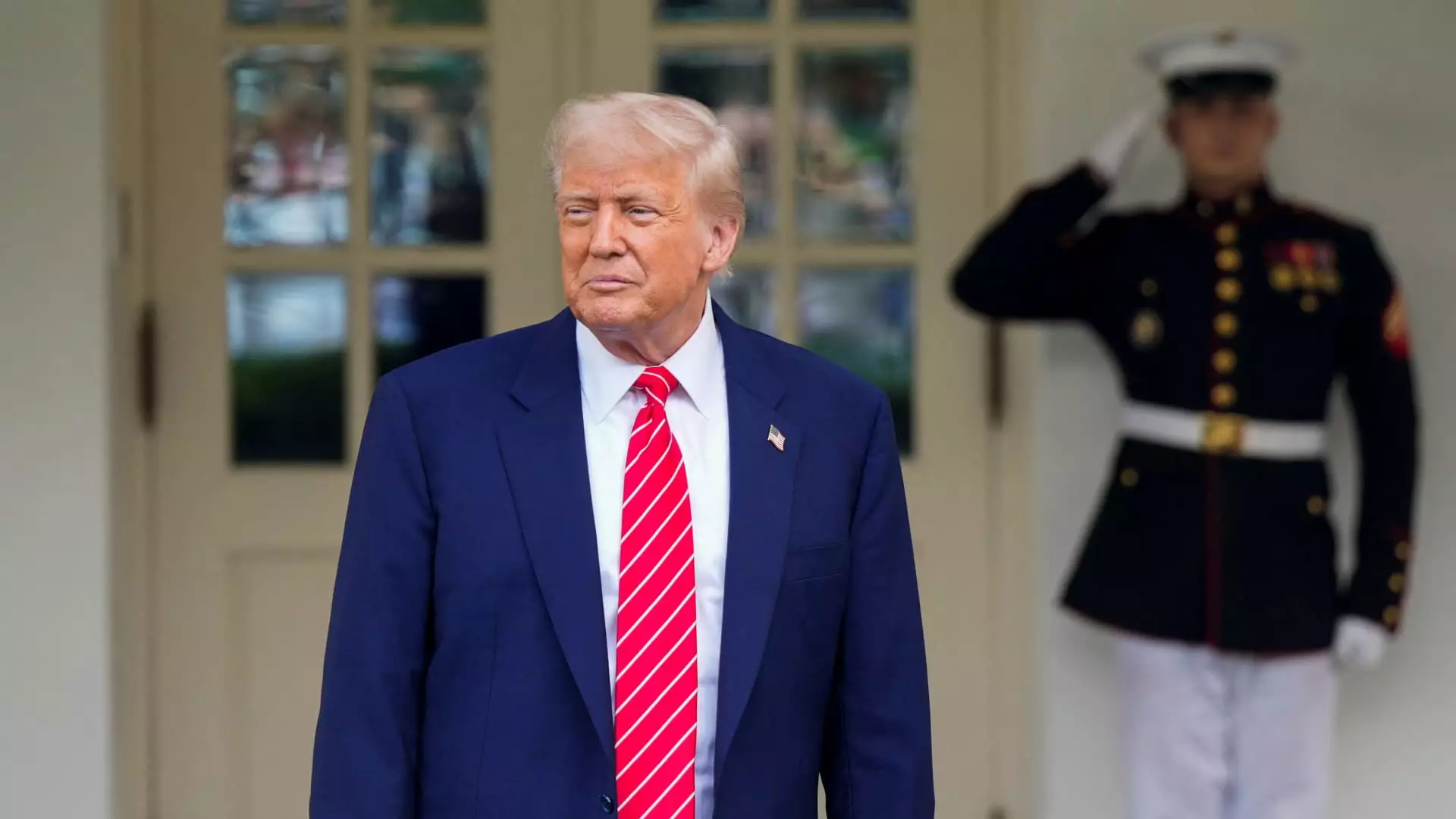

The landscape of cryptocurrency legislation in the United States is increasingly marred by political maneuvering and ethical concerns. President Donald Trump’s personal financial interests have become a significant barrier to passing critical legislation aimed at regulating stablecoins, a vital component of the digital currency ecosystem. Most recently, the failure of the GENIUS Act, designed to establish federal guidelines for stablecoin use, underscores how Trump’s personal crypto enterprises, including his meme coin, are causing unease among lawmakers, ultimately stalling much-needed regulatory advancements.

Senator Jeff Merkley’s assertion that these developments exemplify a “profoundly corrupt scheme” is not mere rhetoric; it speaks to a systemic issue that tarnishes the integrity of the legislative process. Trump’s personal financial empire is no typical blueprint for a president; it raises legitimate concerns that legislative votes could serve self-serving motivations rather than the public good. The intertwining of Trump’s financial pursuits with crypto legislation represents a fundamental conflict of interest that public policy cannot afford to ignore.

Bipartisan Efforts Stifled by Conflicts

The crypto community had found a rare glimmer of hope in the potential for bipartisan support for the GENIUS Act, only to have that light extinguished amidst controversies spurred by Trump’s ongoing personal business ventures. As the bill earned traction and support from both sides of the aisle, a faction of Democratic senators, including those who had previously backed the legislation, shifted their positions due to rising concerns about national security and money laundering. It highlights how personal conflicts can derail even the most bipartisan of initiatives.

Senator Lisa Blunt Rochester pointed directly at Trump’s financial entanglements, claiming they raise red flags about ongoing self-dealing within the presidential family. This situation is a blatant reminder that governmental processes can be curbed by the very individuals meant to protect them. Some lawmakers are not merely making a case against Trump for political gains; they are advocating for the integrity of legislation that could impact millions of American investors and consumers.

The Impact on Investor Confidence

For many in the cryptocurrency sector, Trump’s entanglement with the industry has resulted in a worrying precedent that sullies the primary aim of legislation: to establish a safe and reliable framework for innovation. Ryan Gilbert of Launchpad Capital encapsulates the frustration that many share within this community; personal profit motives overshadow sound policy-making principles. It’s a sentiment that resonates deeply, particularly in an industry desperate for clear guidelines to allow both established players and new entrants to invest and innovate freely.

The ramifications of these unresolved conflicts may stretch far beyond the failure of a single piece of legislation. Investors are left in a limbo where uncertainty reigns; the juxtaposition of Trump’s private gains against public policy casts a long shadow over the U.S. crypto scene. The potential for America to become obsolete on the global stage, as Gilbert suggests, looms large. Without clarity and trust, innovation stutters and investor confidence dissipates.

Ethics Over Profits: A Call for Accountability

The pressure is mounting, with prominent Democrats leading the charge against Trump-appointed crypto projects like World Liberty Financial, which established its own stablecoin while the administration was pushing for relaxed regulations. The suggestive link between Trump’s financial ambitions and potentially nefarious dealings raises urgent questions around accountability. Senator Richard Blumenthal’s call for a rigorous investigation underscores the need for transparency in a sector that thrives on trust and clarity.

The crux of the matter lies in the broader implications for the U.S. economy. As other countries forge ahead with their own legislative frameworks, America risks falling prey to outdated practices and ineffective policies. The mixed messages sent by a sitting president embroiled in financial speculation not only undermine potential legislative efforts but also challenge the country’s reputation as a leading innovator.

As many lawmakers grapple with the prospect of untangling Trump’s personal interests from the legislative process, the U.S. faces a pivotal moment in shaping the future of cryptocurrency regulation. The potential loss of bipartisan support and the enduring conflict of interest could hinder the establishment of a stable and robust environment for digital asset regulation. The outcome of these legislative struggles may ultimately define the character of American innovation and international economic standing, raising the stakes for both the crypto industry and the nation as a whole. With ethical considerations becoming increasingly intertwined with economic aspirations, the outcome remains uncertain as lawmakers continue to navigate this tumultuous landscape.