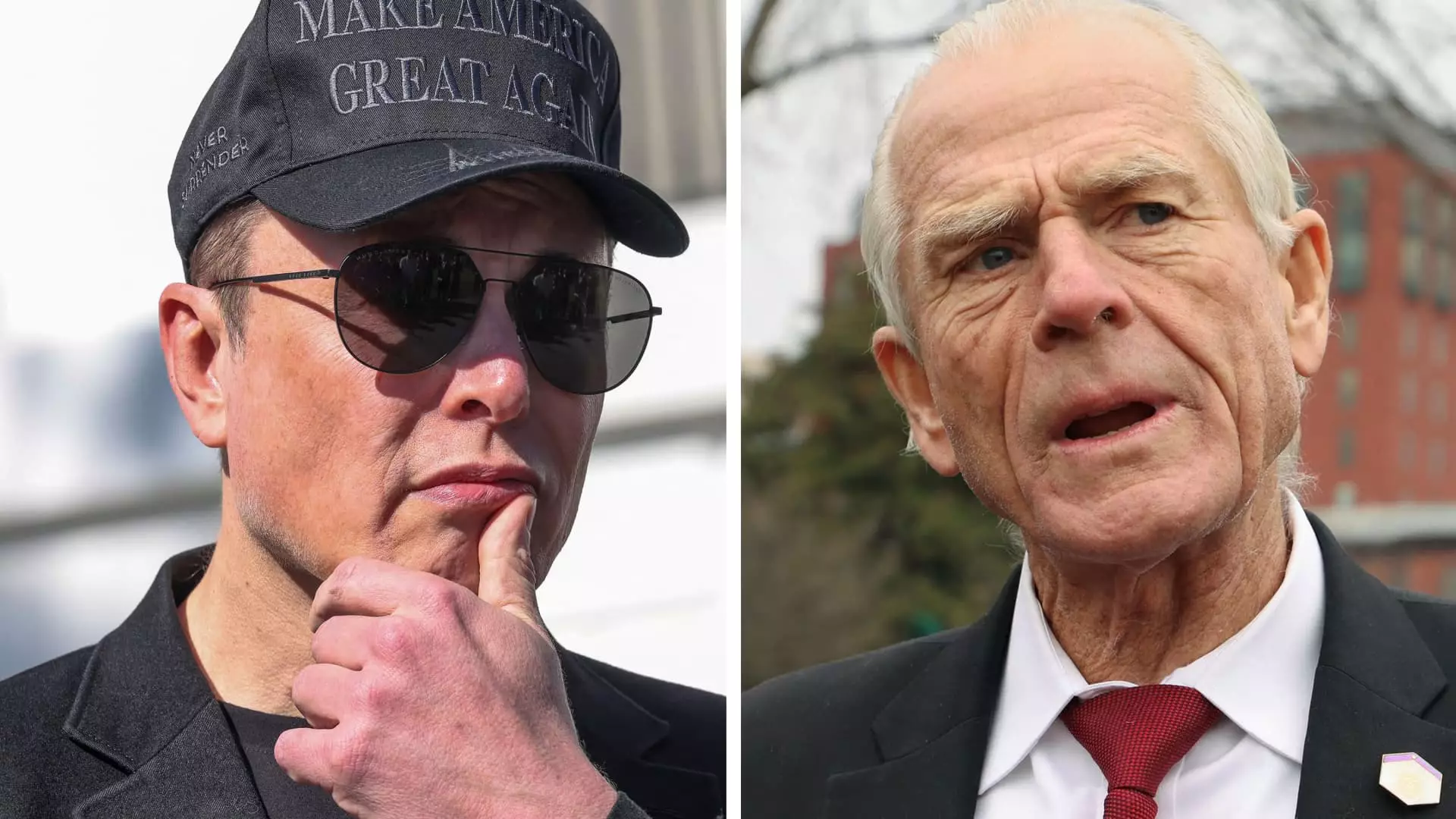

Tesla’s momentous struggle hints at the tipping point that could take the brand from revolutionary icon to a cautionary tale. The latest chapter features none other than the tempest that has erupted between CEO Elon Musk and Peter Navarro, one of President Trump’s economic advisors. Musk, who has once again donned the hat of provocateur, unleashed a torrent of scathing remarks aimed at Navarro’s academic credentials and commentary on trade. With Tesla stocks plummeting for four consecutive days, his outburst seems less about Navarro specifically and more about a fierce defense of a brand grappling with intense scrutiny. In Musk’s words, the degree from Harvard that Navarro proudly flaunts is deemed a liability rather than an asset. It’s a stark reflection of Musk’s disdain not just for Navarro, but also for a broader economic landscape that he feels is impeding his operations.

The stakes are unprecedented as the electric vehicle giant faces severe adversity, with shares down nearly 22% over a mere four trading sessions. From an entrepreneurial perspective, this isn’t just an ego clash; it signals a deeper, systemic issue that could send ripples through Musk’s ambitious goals for a sustainable future. The clash is illustrative of how polarizing trade policies and governmental economics can be detrimental not just to the image of a company but also to its bottom line.

The Tariff Tug-of-War

What underpins this feud is the dizzying array of tariffs proposed by the Trump administration. When Trump slid a blanket tariff on vehicles not assembled in the U.S. onto the economic chessboard, Musk knew that such an unprecedented move wouldn’t play well for his company. While analysts had previously suggested Tesla could weather the storm better than its competitors due to domestic assembly, the specter of increased production costs looms large. The stakes aren’t merely abstract numbers on a balance sheet—they represent tangible dollars and cents lost to misguided policies and muddled strategies.

In one of Musk’s more lucid moments, he articulated what many in the audience likely resonated with: a desire for a zero-tariff environment. Yet, this plea for free trade across Europe and North America stands in stark contrast to the protectionist rhetoric emanating from Trump’s White House. Here lies the irony—Musk, a vocal advocate for a globalized economy, finds himself battling against the very policies of a president he financially backed. This contradiction raises questions about the moral compass guiding corporate interests in turbulent political waters.

A Bridge Too Far for the Brand?

Yet the implications of these trade battles extend beyond immediate capital gains or losses. The fraught atmosphere is compounded by Tesla’s own disappointing metrics, including a staggering 13% decline in year-over-year deliveries, leading to the company’s most dismal quarterly results since 2022. In a world where innovation ought to translate into growth, the disconnect between Musk’s ambitions and Tesla’s performance starkly illustrates the fragility of market confidence. Musk’s money and influence were supposed to shield him from the vagaries of political winds, but as reality shows, no amount of backing can insulate a corporation from unfavorable legislation or reputational challenges.

In an odd twist, the public clash has not merely remained a private spat; it has morphed into a soapbox moment for Musk to react against the trades of Washington. Onlookers are privy to a CEO who is willing to gamble with public sentiment and corporate reputation in a bid to redefine economic discourse—even if it means taking on one of his own political allies. It’s a spectacle, yes, but behind this bravado lies a deeply woven fabric of anxiety, profit margins, and corporate survival.

The Consequences of Division

Ironically, the White House seems nonchalant about this public spurring, with Press Secretary Karoline Leavitt dismissing it as “boys will be boys.” This laissez-faire approach underscores an American political landscape fraught with division and discord. When the strategies of government and business clash, the fallout doesn’t just affect CEOs—it spills into job markets, consumer choices, and, ultimately, the economy at large.

Amid this chaos, could it be that Navarro’s comments, albeit contentious, strike at what Musk has failed to address? The crumbling edifice of Tesla is symptomatic of a larger crisis where innovators are at odds with outdated economic schools of thought. If Musk truly wants to revolutionize transportation and energy, he must reconcile his world of vision with the harsh realities of economic governance and societal expectations, or prepare to watch as his electric dreams fade away into the background.